Loading

Get Sc Sc8857 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC SC8857 online

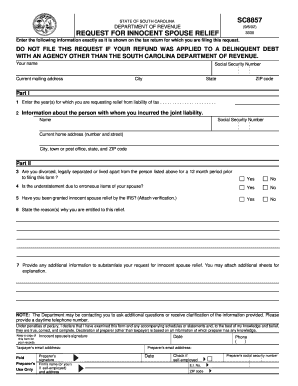

The SC SC8857 form is the request for innocent spouse relief in the State of South Carolina. This guide provides detailed, step-by-step instructions to help users fill out the form accurately and confidently online.

Follow the steps to complete the SC SC8857 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name and social security number as indicated in the form. Ensure that the information exactly matches what is shown on your tax return.

- Provide your current mailing address, including the city, state, and ZIP code to ensure that any correspondence related to your request is sent to the right location.

- In Part I, specify the year(s) for which you are requesting relief from tax liability.

- Enter information about the person with whom you incurred the joint liability, including their name, social security number, and current home address.

- Proceed to Part II, answering whether you are divorced, legally separated, or have lived apart from the person listed above for a 12-month period prior to filing this form. Select ‘Yes’ or ‘No’ as applicable.

- Indicate whether the understatement of tax is due to erroneous items of your spouse by selecting ‘Yes’ or ‘No.’

- If you have previously been granted innocent spouse relief by the IRS, indicate this and attach verification.

- State the reason(s) why you believe you are entitled to innocent spouse relief in the designated field.

- Provide any additional information that can support your request for relief, and attach extra sheets if necessary.

- Include your daytime telephone number for potential follow-up questions from the Department of Revenue.

- Review your entries for accuracy, then sign the form to declare that the information provided is true and correct.

- At the conclusion of filling out the form, you can save your changes, download, print, or share the completed SC SC8857 form as needed.

Complete your SC SC8857 form online today for a smoother process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file form 8857, you should submit it to the South Carolina Department of Revenue. It's crucial to ensure that you fill out the form completely before submitting it to avoid delays. You can file the form by mailing it to the designated address provided on the form or potentially online through the Department’s website. Resources available at USLegalForms can help you complete and file the SC SC8857 correctly, making the process smooth.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.