Loading

Get Au 11 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Au 11 form online

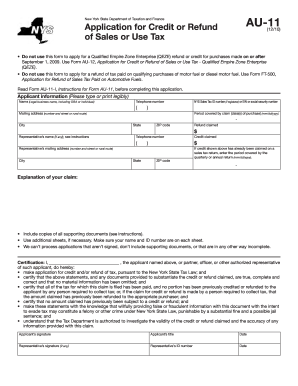

The Au 11 form is essential for individuals and businesses seeking a credit or refund of sales or use tax in New York State. This guide provides comprehensive, step-by-step instructions for successfully filling out the form online.

Follow the steps to complete the Au 11 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your applicant information. This includes the legal business name or individual name, telephone number, and your New York State sales tax ID number, or EIN or social security number. Make sure the information is typed or printed legibly.

- Provide your mailing address, including number and street or rural route, city, state, and ZIP code.

- Indicate the period covered by your claim by entering the date(s) of purchase in the mm/dd/yyyy format.

- If you have a representative, enter their name, telephone number, and mailing address. Ensure this section is filled out per the provided instructions.

- State the amount of refund claimed and if credit has been claimed on a sales tax return, include the period covered by the quarterly or annual return in the required format.

- In the explanation section, detail the basis of your claim. Remember to include copies of all supporting documents and use additional sheets if necessary while ensuring they are properly labeled.

- Complete the certification to confirm that all information submitted is accurate and that you acknowledge the potential consequences of false information. Sign and date the application accordingly.

- Review your completed form to ensure all required fields are filled out correctly, then save the changes, and proceed to download, print, or share the form as needed.

Complete your Au 11 form online today for an efficient tax refund experience.

Filing Form 11 in Ireland requires you to report your income, gains, and credits accurately. This form is essential for self-assessment tax returns and is different from the AU11 form used in the USA. Start by collecting your financial documents and detailing your sources of income. If you need assistance with filing, uslegalforms can provide valuable resources to simplify your experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.