Get Ok Form 511 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK Form 511 online

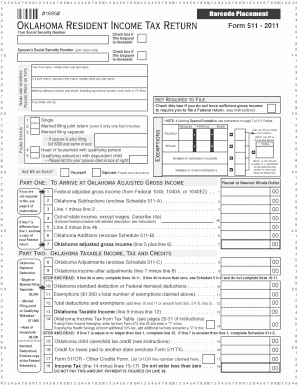

Filling out the OK Form 511 online is a straightforward process that allows users to submit their Oklahoma resident income tax return efficiently. This guide provides step-by-step instructions to help users navigate through each section of the form with confidence.

Follow the steps to fill out the OK Form 511 online.

- Press the ‘Get Form’ button to access the OK Form 511. This will allow you to open the form and begin filling it out online.

- Enter your Social Security Number in the designated field. This is a required section to identify your tax records accurately.

- If filing a joint return, include your spouse’s Social Security Number. Ensure both numbers are accurate for proper processing.

- Provide your name and mailing address in the specified sections. Use clear and legible text, either by typing or printing.

- Select your filing status from the options available, including Single, Married Filing Joint, and Head of Household. Ensure you understand which option applies to your situation.

- List any dependents you are claiming, being sure to provide their names and Social Security Numbers where applicable.

- Calculate your federal adjusted gross income as required. Refer to your federal tax return documentation to ensure accuracy.

- Complete any additional sections for Oklahoma subtractions and additions, including relevant schedules like Schedule 511-A and Schedule 511-B where necessary.

- Review your deductions and exemptions carefully, ensuring all calculations are correct. Make adjustments as needed.

- Finalize your tax calculations, entering the amount owed or the refund desired. Double-check that your math is accurate.

- Once you have completed all sections, you can save your changes, download the completed form, print it for your records, or share it online if needed.

Start filling out your OK Form 511 online today to ensure timely submission and compliance with tax regulations.

Get form

To qualify for the Oklahoma earned income credit, you must meet specific income limits and have earned income from employment or self-employment. Additionally, your filing status and the number of qualifying children can affect your eligibility. This credit can significantly reduce your tax liability, so it is essential to understand the requirements. Remember to refer to OK Form 511 when claiming this benefit to ensure you meet all guidelines.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.