Loading

Get Form 15cb

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 15CB online

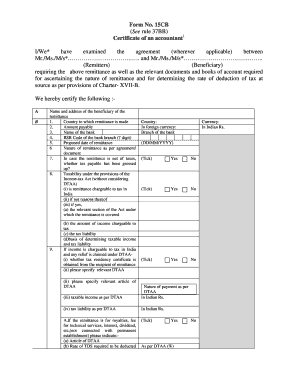

This guide provides a detailed overview of how to fill out Form 15CB, an essential document for remittance to non-residents under the Income-tax Act. By following these instructions, you can complete the form accurately and efficiently.

Follow the steps to fill out the Form 15CB online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the details of the remitters and beneficiaries. In the designated fields, enter the names of the individuals or entities involved, ensuring you include their correct titles as applicable.

- Provide the country to which the remittance is being made. Ensure to enter the name accurately to avoid any discrepancies.

- Fill in the amount payable. Specify the total sum being remitted in the appropriate field.

- Enter the name of the bank handling the transaction. This should correspond to the bank where the remittance will be processed.

- Input the BSR code of the bank branch, ensuring it is a 7-digit code, as this is crucial for identifying the exact branch of the financial institution.

- Specify the proposed date of remittance, formatted as DD/MM/YYYY.

- Detail the nature of remittance as per the agreement or document indicating the reason for the transfer.

- Indicate whether the remittance is net of taxes, and if so, confirm if tax payable has been grossed up.

- Assess the taxability under the Income-tax Act, answering the provided questions to clarify whether the remittance is chargeable to tax in India.

- If applicable, provide details regarding the tax residency certificate and specify relevant DTAA articles.

- Complete the necessary sections regarding payments such as royalties or technical services fee, including article of DTAA and applicable rates of TDS.

- Finalize the form by confirming tax obligations based on the nature of income and income tax due, specifying rates and amounts as required.

- After completing all required fields, save your changes. You may also download, print, or share the completed form as necessary.

Complete your Form 15CB online today!

Filling out Form 15CB requires specific details about the remittance, your tax residency status, and other important information. You will need to provide accurate data and ensure you comply with the requirements mentioned by the authorities. A platform like uslegalforms can guide you through the process, ensuring that you don’t miss any critical details. Always double-check your entries before submission to avoid issues down the line.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.