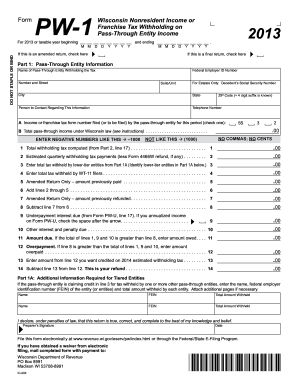

Get Wi Pw-1 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign WI PW-1 online

How to fill out and sign WI PW-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The era of frightening intricate tax and legal paperwork is behind us. With US Legal Forms, the process of generating legal documents is stress-free. A powerful editor is already at your disposal providing you with various useful tools for completing a WI PW-1. These instructions, along with the editor, will guide you through the entire process.

We simplify the process of completing any WI PW-1 significantly. Start now!

- Click the orange Get Form button to begin editing.

- Activate the Wizard mode in the top toolbar to receive additional assistance.

- Complete each fillable section.

- Ensure the information you input into the WI PW-1 is accurate and current.

- Add the date to the document using the Date feature.

- Click the Sign icon and create a signature. You will have three choices: typing, drawing, or capturing one.

- Verify that every section has been filled in correctly.

- Select Done in the top right corner to save the document. There are multiple options for obtaining the file: as an instant download, an attachment in an email, or by mail as a hard copy.

How to modify Get WI PW-1 2013: personalize forms online

Your easily adjustable and adaptable Get WI PW-1 2013 template is at your fingertips. Maximize our collection with an integrated online editor.

Do you delay finalizing Get WI PW-1 2013 because you just don’t know where to begin and how to advance? We empathize with your situation and offer an excellent solution that has nothing to do with battling your procrastination!

Our online inventory of ready-to-modify templates allows you to sift through and select from thousands of fillable forms tailored for an array of applications and situations. However, acquiring the document is just the beginning. We equip you with all the essential tools to fill out, authenticate, and alter the document of your preference without leaving our site.

All you need to do is access the document in the editor. Review the wording of Get WI PW-1 2013 and confirm whether it aligns with your needs. Initiate adjustments to the form using the annotation features to present your form in a more systematic and polished appearance.

In conclusion, alongside Get WI PW-1 2013, you will receive:

- Insert checkmarks, circles, arrows, and lines.

- Emphasize, redact, and amend the existing text.

- If the document is intended for others as well, you can incorporate fillable fields and distribute them for other parties to complete.

- Once you finish adjusting the template, you can download the document in any supported format or select any sharing or delivery methods.

- A robust array of editing and annotation capabilities.

- An integrated legally-binding eSignature feature.

- The choice to create documents from scratch or based on the pre-existing template.

- Compatibility with different platforms and devices for enhanced convenience.

- Multiple options for safeguarding your documents.

- A wide variety of delivery methods for simpler sharing and distribution of documents.

Get form

Related links form

The Wisconsin withholding tax rate varies depending on income level and filing status, with rates ranging from 3.54% to 7.65%. Employers must apply the correct rate based on their employees' earnings to ensure proper tax collection. Keeping up-to-date with withholding tax rates is critical under the WI PW-1 framework. For assistance, consider leveraging the comprehensive solutions offered by uslegalforms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.