Loading

Get In Dor It-40 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DoR IT-40 online

Filling out the IN DoR IT-40 form online can be a straightforward process. This guide will provide you with clear and detailed steps to ensure you complete your Indiana Full-Year Resident Individual Income Tax Return accurately.

Follow the steps to complete your form online.

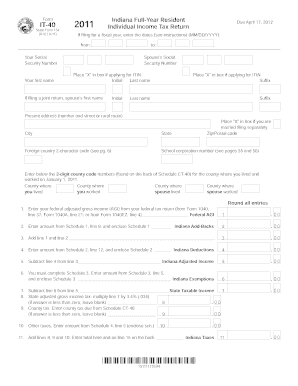

- Click ‘Get Form’ button to obtain the IT-40 form and open it in the editor.

- Enter your social security number in the designated field, ensuring its accuracy to avoid processing delays.

- Provide your first name and last name, including initials and suffix if applicable.

- If filing jointly, fill in your spouse’s social security number and their first and last name.

- Indicate your present address, including the number and street or rural route, city, state, and zip/postal code.

- If applicable, enter the 2-character code for any foreign country and your school corporation number.

- List the county codes for where you lived and worked as well as your spouse's county codes on January 1, 2011.

- For line 1, input your federal adjusted gross income from your federal tax return.

- On line 2, enter the amount from Schedule 1 and include that schedule with your submission.

- Add lines 1 and 2 for your total on line 3.

- Complete Schedule 2 and enter the amount in line 4.

- Subtract line 4 from line 3 to find your Indiana adjusted income for line 5.

- Fill out Schedule 3 and enter the amount from line 5 on line 6.

- Subtract line 6 from line 5 for your state taxable income on line 7.

- Calculate the state tax based on line 7 and enter it on line 8.

- Enter any county tax due from Schedule CT-40 on line 9.

- For line 10, include any other taxes from Schedule 4.

- Add lines 8, 9, and 10, and place the total on line 11.

- Enter any credits from Schedule 5 on line 12 and offset credits from Schedule 6 on line 13.

- Calculate your total credits on line 14 and compare with total taxes on line 15.

- If applicable, determine overpayment on line 18 and decide how much to apply toward estimated tax.

- Finally, check the penalties for underpayment from Schedule IT-2210 if necessary and prepare your refund or amount due.

- Sign and date the return after reviewing the authorization statement.

- Save your changes, and then download, print, or share your completed form as required.

Complete your documents online for a streamlined filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out a basic 1040 form, start with your personal details and follow the steps to report your income. Include various income sources, such as wages and dividends, and apply any deductions you may qualify for. It is crucial to ensure accuracy to avoid penalties. You may find specific instructions and tools beneficial for a smooth filing experience, such as those offered by US Legal Forms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.