Get Irs 14039-b 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 14039-B online

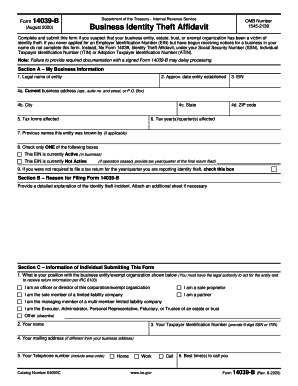

The IRS 14039-B form is used to report instances of business identity theft. Completing this form online allows individuals or representatives of business entities to provide necessary information to the IRS swiftly and efficiently. This guide will help you navigate each section of the form to ensure all required information is accurately submitted.

Follow the steps to complete the IRS 14039-B form online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out Section A, which includes entering the legal name of your entity, the approximate date it was established, and its Employer Identification Number (EIN). Provide the current business address, city, state, and ZIP code, followed by details on tax forms affected and the tax year(s) or quarter(s) impacted.

- In Section B, provide a detailed explanation of the identity theft incident. If necessary, use an additional sheet of paper to supply complete information.

- For Section C, indicate your relationship to the business entity or exempt organization. Include your name, Taxpayer Identification Number, mailing address (if different), and contact telephone number. Specify the best times to reach you.

- Fill out Section D by providing any known information regarding individuals misusing your EIN or name. Attach necessary supporting documents, ensuring to check the appropriate box for the documentation type based on your entity.

- In Section E, sign and date the form to declare that the information provided is true and correct.

- Once you have completed all sections, you can save your changes, download, print, or share the form as needed. Follow the IRS submission guidelines as detailed on the form.

Complete the IRS 14039-B form online today to report business identity theft.

On Form 14039-B, you should fill out the section related to dependents if you are reporting identity theft tied to your tax returns involving dependent claims. Detail the names and Social Security numbers of your dependents accurately. This helps the IRS understand the full scope of the identity theft issue and take appropriate action.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.