Loading

Get Calyx Form - Loanapp1.frm 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Calyx Form - Loanapp1.frm online

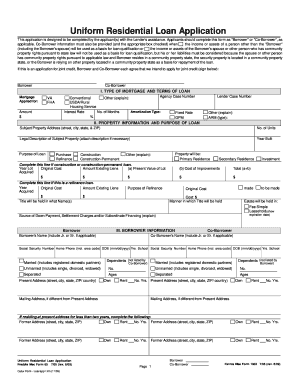

Filling out the Calyx Form - Loanapp1.frm is an essential step in the mortgage loan application process. This guide provides clear, step-by-step instructions to help applicants complete the form accurately and efficiently.

Follow the steps to successfully complete the Calyx Form - Loanapp1.frm.

- Click ‘Get Form’ button to obtain the form and open it in your editing interface.

- Begin with section I, where you will choose the type of mortgage and terms of the loan. Select from options like conventional, USDA, VA, or FHA. Fill in the agency case number, interest rate, amortization type, and desired loan amount.

- Proceed to section II for property information. Enter the subject property address, the number of units, and the year built. Specify the purpose of the loan, such as purchase, refinance, or construction, and provide a legal description if required.

- In section III, provide detailed borrower information, including names, social security numbers, and contact information for both the borrower and co-borrower. Be sure to also include personal information such as marital status and dependents.

- Complete section IV on employment information for both the borrower and co-borrower. Document the employer’s name, address, position, and years employed, along with detailed income information.

- In section V, provide your monthly income and combined housing expenses. List your gross monthly income for both borrower and co-borrower while detailing housing expenses.

- Move to section VI to outline assets and liabilities. Provide descriptions of all assets, including bank accounts and real estate, and list outstanding liabilities such as loans and debts.

- In section VII, summarize details of the transaction such as the purchase price and any alterations or improvements being made.

- Complete section VIII by answering declarations about your financial history and obligations to ensure transparency and compliance.

- In the final sections, acknowledge and agree to all statements by signing and dating the form. Review all entries to confirm accuracy before proceeding to save, download, or print the completed application.

Complete your documents online to facilitate a smooth mortgage loan application process.

Calyx Path offers a comprehensive platform for managing loans from start to finish, while Calyx Point focuses specifically on the origination process. Each tool serves distinct functions but is designed to streamline operations for lenders. Incorporating both systems can maximize efficiency, especially when using forms like the Calyx Form - Loanapp1.frm to gather necessary data.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.