Loading

Get Security Benefits 32-77944-13 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Security Benefits 32-77944-13 online

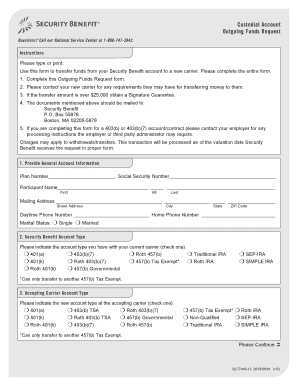

This guide provides a comprehensive overview on how to complete the Security Benefits 32-77944-13 form online. It aims to support users by breaking down each section and field, ensuring you have the clarity needed to process your transfer effectively.

Follow the steps to complete the form accurately

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Provide general account information including your plan number, social security number, and participant name. Ensure that the details are accurate to avoid processing delays.

- Indicate your security benefit account type by checking the appropriate box. Options include various retirement account types such as 401(k), IRA, and more.

- Provide details about the accepting carrier information. Include the name, mailing address, account number, and phone number of the new carrier.

- Obtain the accepting carrier's signature, which verifies their acceptance of the transfer.

- If applicable, complete the required minimum distribution section to meet any necessary distribution requirements before transferring funds.

- Select the type of transfer, exchange, or rollover you are executing. Be sure to check the correct box indicating your choice.

- Complete the distribution requirements section, certifying that your request abides by all applicable requirements.

- Indicate the amount to be transferred, specifying whether you wish to liquidate your entire account or a specified amount.

- Acknowledge any active loans on your account if you are requesting a full withdrawal, confirming your understanding of the consequences.

- Select one or more reasons for the transfer and provide additional details if necessary.

- Finally, provide the required signatures of the participant, any relevant plan sponsor, and financial advisor, along with confirming spousal consent if applicable.

Complete your Security Benefits 32-77944-13 form online now to ensure a smooth and efficient transfer process.

For inquiries related to the DFAS survivor benefit plan, you can reach the designated help desk at the number specified on the DFAS website. They provide guidance on the benefits available under the Security Benefits 32-77944-13 plan, ensuring you receive the assistance needed. Keeping this contact information accessible can help you streamline communication and get timely answers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.