Loading

Get Tx Enhr Rpt Form 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX ENHR RPT Form online

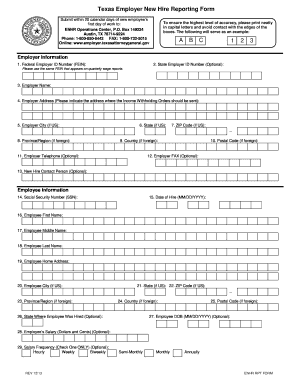

This guide offers clear and comprehensive instructions on how to fill out the Texas Employer New Hire Reporting Form (TX ENHR RPT Form) online. By following the steps outlined below, users can ensure accurate completion of the form, fulfilling all reporting requirements diligently.

Follow the steps to complete the TX ENHR RPT Form online

- Click the ‘Get Form’ button to access and open the TX ENHR RPT Form in your preferred editor.

- Begin by entering the employer information in the designated fields. Be sure to provide your Federal Employer ID Number (FEIN) in Box 1. This is a crucial identifier for tax purposes and should match the number on your quarterly wage reports.

- In Box 2, you may enter your optional State Employer ID Number if applicable. Proceed to complete Box 3 with your employer name as it appears on the employee’s W4 form, ensuring clarity by listing only one name.

- Fill in Box 4 with the complete employer address for the income withholding orders. Ensure that no additional addresses are included, as this can lead to processing errors.

- Complete the next fields that require details such as city, state, ZIP code, and, if applicable, foreign address information including province/region and country.

- Optionally, complete Box 11 with your telephone number, and provide contact information in Box 13 if desired for a new hire representative.

- Continue to the employee information section. Provide the employee’s Social Security Number (SSN) in Box 14 and the date of hire in Box 15, formatted as MM/DD/YYYY.

- Enter the employee's first, middle, and last names in Boxes 16, 17, and 18 respectively, followed by their home address details in Boxes 19 to 22.

- If the employee resides outside the United States, fill in the optional information for province/region, country, and postal code in Boxes 23 to 25.

- In Box 27, you may enter the employee’s date of birth and the salary information in Boxes 28 and 29, providing the salary frequency selected.

Complete your TX ENHR RPT Form online today to ensure timely compliance with new hire reporting requirements.

Yes, you are required to report new hires in Texas. The TX ENHR RPT Form must be submitted for every new employee within 20 days of their start date. Compliance with this reporting requirement not only adheres to state law but also supports efficient payroll processes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.