Get Form W-8ben Retroactive Statement Existing Vendors

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-8BEN Retroactive Statement for existing vendors online

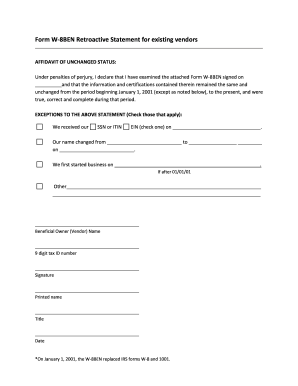

Filling out the Form W-8BEN Retroactive Statement can be essential for existing vendors to certify their status for tax purposes. This comprehensive guide will walk you through each section of the form, ensuring a smooth online completion process.

Follow the steps to accurately complete the form online.

- Press the ‘Get Form’ button to access the form for online completion.

- In the affidavit section, confirm the accuracy of your information. State, under penalties of perjury, that you have examined the attached Form W-8BEN and that the information has remained unchanged since January 1, 2001, unless noted otherwise.

- In the exceptions section, check any applicable boxes. Options may include updates to your tax identification numbers or any name changes. Make sure to provide dates where required.

- Fill in the beneficial owner (vendor) name in the designated field to identify yourself accurately.

- Enter your nine-digit tax identification number in the appropriate section.

- Sign the form in the signature section, providing your name clearly in the printed name area.

- Complete the title and date fields to finalize your form. Ensure all sections are filled out accurately.

- Once completed, you can save changes, download, print, or share the form as required.

Complete your Form W-8BEN Retroactive Statement online to ensure your vendor status is properly certified.

Related links form

The W-8BEN form is mandatory for foreign individuals receiving payments from U.S. sources to avoid higher withholding taxes. It serves as a certification of your foreign status and may allow you to benefit from tax treaties. By submitting the Form W-8BEN Retroactive Statement, existing vendors can ensure compliance while minimizing tax obligations. Therefore, it’s important to file this form to protect your interests.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.