Loading

Get Zw Form P2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ZW Form P2 online

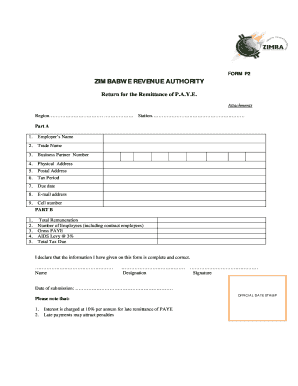

Filling out the ZW Form P2 is an essential process for employers to report their Pay-As-You-Earn (P.A.Y.E.) tax remittances accurately. This guide will provide you with a clear, step-by-step approach to complete the form online, ensuring all necessary information is included for compliance with the Zimbabwe Revenue Authority.

Follow the steps to complete the ZW Form P2 online.

- Click the ‘Get Form’ button to obtain the ZW Form P2 and open it in your preferred online editing tool.

- In Part A, fill in the employer's name, trade name, and business partner number accurately. Ensure that all details reflect your business registration documents.

- Provide your physical and postal addresses. Verify that these addresses are current and correct, as they are essential for communication with the revenue authority.

- Enter the tax period for which you are submitting this form. This is typically the month or quarter in which the tax was withheld.

- Indicate the due date for the remittance of P.A.Y.E. This is critical to avoid late fees and penalties.

- Fill in your email address and cell number to ensure that you can be contacted regarding this submission.

- In Part B, provide the total remuneration you have paid to your employees, including any contract workers.

- Enter the total number of employees for whom you are reporting, ensuring to include both permanent and contractual staff.

- Calculate the gross P.A.Y.E. based on the remuneration provided, and ensure that this amount is accurate.

- Calculate the AIDS levy at 3% of the gross P.A.Y.E. and include this as a separate line item.

- Calculate the total tax due by adding the gross P.A.Y.E. and the AIDS levy.

- In the declaration section, ensure a person who is authorized to submit the form signs it, including their name, designation, and the date of submission.

- After completing the form, review all entries for accuracy, and ensure all fields are filled out completely before finalizing.

- Save your changes, then download and print the completed ZW Form P2 for your records. You may share the form electronically as required.

Complete your ZW Form P2 online today to ensure timely compliance with tax regulations.

Exempt income in Zimbabwe refers to income that is not subject to tax under specific regulations. Utilizing the ZW Form P2, you can identify various types of exempt income, including grants, subsidies, and certain compensations. Understanding these specifics can help you plan effectively and minimize your taxable income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.