Loading

Get Hsbc Form 15g 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HSBC Form 15G online

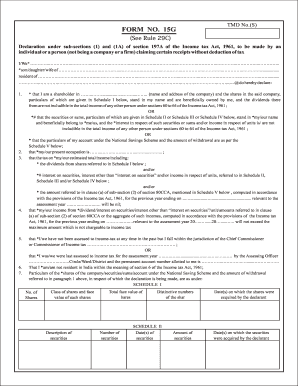

Filling out the HSBC Form 15G online can simplify the process of declaring certain receipts without tax deductions. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the HSBC Form 15G and open it in your preferred platform.

- In the first section, fill in your name, explicitly stating whether you are an individual or a qualifying person. Make sure to include details such as your relationship—son, daughter, or partner—of the individual you mention.

- Provide your residential address clearly, ensuring that all relevant details are included for accuracy.

- Indicate your occupation in the designated field. This information is important for the declaration.

- Choose the appropriate option regarding your status as a shareholder, using Schedule I if applicable. Fill in relevant details about the shares owned, including quantity, class, and acquisition dates.

- If applicable, use Schedule II, III, or IV to declare securities, sums, or units held. Enter descriptions, acquisition dates, amounts, and any additional required details as per the form's instructions.

- Complete the verification section at the end of the form, providing your signature and date of completion to affirm the correctness of your declaration.

- Review all filled-out sections carefully to ensure accuracy. Once satisfied, you can save changes, download the document, print it, or share it as required.

Enhance your document management skills by completing your forms online today.

Yes, HSBC Form 15G can often be filled online through the bank's official website or mobile app. This feature facilitates a convenient way to submit your declaration without visiting a branch. Ensuring the accuracy of your information is vital when completing the form online.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.