Loading

Get Mn M60 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN M60 online

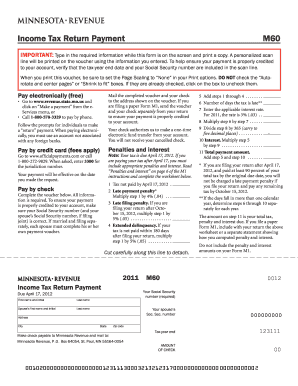

Filling out your MN M60 form online is a straightforward process that helps you submit your income tax return payment efficiently. This guide will provide step-by-step instructions to ensure that you complete the form accurately and understand the necessary components.

Follow the steps to fill out the MN M60 online successfully.

- Click the 'Get Form' button to access the MN M60 form. Ensure that your device is prepared to edit the document as you complete it.

- Begin by entering your last name in the designated field at the top of the form. Make sure to type clearly and accurately.

- Enter your first name and initial in the corresponding fields. If applicable, include your spouse’s first name and initial as well.

- Provide your Social Security number in the required field. If filing jointly, also enter your spouse's Social Security number.

- Fill in your address, including city, state, and zip code, to ensure your payment is linked correctly to your account.

- Specify the tax-year end date in the designated field; for this form, enter '123111' for the year indicated.

- Calculate your total payment amount. Include any applicable penalties or interest as indicated in the worksheet sections.

- Review your entries for accuracy, particularly focusing on the scan line that includes your Social Security number.

- Once all information is entered and verified, save the changes to your form. You may choose to download, print, or share the completed document as needed.

Complete your MN M60 form online today to ensure timely and accurate processing of your income tax return payment.

You should use your current home address on your tax return, as this is where you are officially residing. This address is linked to your personal and financial information, making it vital for proper communication with tax authorities. If you're uncertain about your filings, uslegalforms can assist you in ensuring your paperwork is correct and up to date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.