Get Wf 10576 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WF 10576 online

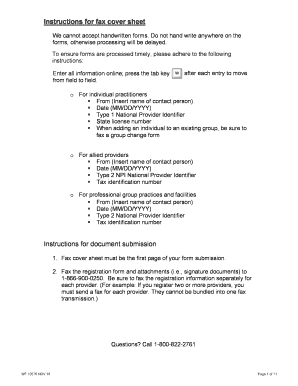

Filling out the WF 10576 form online is an essential step for new practitioners seeking enrollment with Blue Cross Blue Shield of Michigan and Blue Care Network. This guide provides you with a structured approach to accurately complete the necessary fields and ensure a smooth submission process.

Follow the steps to successfully complete the WF 10576 form online.

- Click the ‘Get Form’ button to obtain the WF 10576 form and open it in the editor.

- In the header section, fill in the 'From' field with the full name of the contact person, and enter the date in MM/DD/YYYY format.

- For Type 1 national provider identifier, enter your identifier in the designated field. If applicable, also input your state license number.

- Complete Section 1 by entering your demographic data, including your first name, middle name, last name, degree, date of birth, gender, race/ethnicity, and county of primary address. Ensure all fields marked with an asterisk (*) are filled out as they are mandatory.

- In Section 2, provide your tax information by entering your social security number and specifying if your EIN/Tax ID number is the same as your SSN.

- Proceed to Section 3 and indicate your primary specialty. Answer questions regarding board certification and whether you practice exclusively in a hospital setting.

- In Section 4, select the networks you are applying to by placing a checkmark next to the relevant options.

- Complete Section 5 by providing your primary office address and frequently used contact information. Ensure that all required fields including street address, city, state, and zip code are completed.

- In Sections 6 and 7, list the services you provide and any additional solo practice locations as necessary.

- Fill out Section 8 for Provider Secured Services if relevant, and indicate if you want to authorize any user access.

- In Section 9, review the legal and ethical declarations, then sign and date the application. Print or type your name where indicated.

- Finalize your form submission by saving changes, sharing, or printing the completed form as necessary.

Take the first step towards your enrollment by completing the WF 10576 form online.

Get form

The amount you should list as a dependent on your W4 is based on the current guidelines set by the IRS, which may change yearly. The WF 10576 resources clarify how to calculate this amount so that your tax withholdings reflect your actual tax burden adequately. Properly claiming dependents can lead to better financial outcomes during tax season, so make sure to stay informed.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.