Get Irs W-3 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-3 online

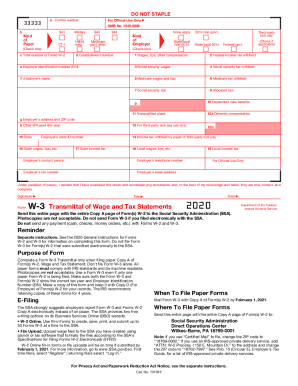

The IRS W-3 form serves as a transmittal document for wage and tax statements, particularly when filing paper copies of Form W-2. This guide will provide you with clear, step-by-step instructions on how to fill out the W-3 online, ensuring that you can complete this essential form accurately and efficiently.

Follow the steps to complete the IRS W-3 form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your Employer Identification Number (EIN) in the appropriate field. This unique identifier is crucial for tax purposes and links to your business information.

- Fill in your employer's name and address. Make sure this information matches what is on your W-2 forms.

- Enter the total number of W-2 forms you are submitting. This should reflect all Forms W-2 that correspond to the filings for the tax year.

- Complete the wages and tax sections, including the total wages, federal income tax withheld, social security wages, and other relevant amounts as indicated on the form.

- Review other optional fields such as state income tax information if applicable to your reporting requirements.

- Sign and date the form in the designated areas. This affirms that the information you are providing is accurate and complete.

- Once all fields are filled out, you can save changes, download, print, or share the completed form as needed.

Start filling out your IRS W-3 online to ensure a smooth filing experience.

Get form

The key difference between the W-2 and W-3 forms lies in their function. The W-2 reports individual earnings and taxes withheld for each employee, while the W-3 summarizes this data for the IRS. The W-3 is essentially a cover sheet for all W-2 forms filed by an employer during the tax year. Recognizing this difference helps you understand how to manage your payroll reporting effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.