Get Irs 14039-b 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 14039-B online

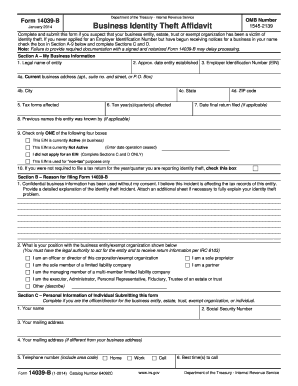

Completing the IRS 14039-B online is a critical step for individuals who suspect their business identity has been stolen. This guide provides a comprehensive, step-by-step overview of how to accurately fill out this form, ensuring your submission is complete and effective.

Follow the steps to successfully complete the IRS 14039-B form.

- Click ‘Get Form’ button to obtain and open the 14039-B form in an online editor.

- Begin with Section A, where you will input the legal name of your business entity, the date it was established, and your Employer Identification Number (EIN). Make sure to provide the current business address, including details such as the suite number or P.O. Box, city, state, and ZIP code. Specify the tax forms and tax year(s) affected.

- In Section B, explain the reason for filing the form. Indicate if confidential business information has been used without consent, and provide a detailed account of the identity theft incident. If necessary, attach additional sheets for more information.

- Proceed to Section C, where you will complete personal information, including your name, Social Security Number, mailing address, and telephone number. If your address differs from your business address, include that as well.

- In Section D, affirm the information provided is true by signing and dating the form. You may submit one of two options: have the form notarized or attach a copy of the police report indicating you are a victim of identity theft.

- Lastly, review all provided documentation in Section 4 to ensure completeness. Check the required documents for your business type and attach copies.

- When finished, save the changes. You may download, print, or share the IRS 14039-B form as needed following your submission process.

Complete your IRS 14039-B form online today to address your business identity theft concerns.

Get form

Yes, you should fill out an identity theft affidavit if you believe you have been a victim of identity theft. The identity theft affidavit, including form 14039-B, helps protect your tax records and prevents fraudulent claims on your account. Completing this form is a crucial first step to secure your identity and rectify any discrepancies with the IRS. US Legal Forms can assist you in filling out this important document seamlessly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.