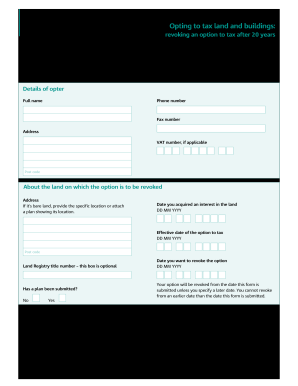

Get Uk Hmrc Vat1614j 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign UK HMRC VAT1614J online

How to fill out and sign UK HMRC VAT1614J online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Legal, taxation, commercial along with other electronic documents require a heightened level of safeguarding and adherence to the regulations. Our templates are consistently refreshed to align with the most recent changes in the laws.

Moreover, with our service, all the details you input in your UK HMRC VAT1614J are securely protected against loss or harm via superior file encryption.

Our platform allows you to manage the whole process of completing legal documents online. As a result, you save hours (if not days or even weeks) and reduce extra costs. From now on, complete UK HMRC VAT1614J from the ease of your home, workplace, or even while traveling.

- Access the document in the comprehensive online editor by clicking Get form.

- Complete the required fields which are highlighted in yellow.

- Click the arrow labeled Next to navigate from box to box.

- Proceed to the e-signature feature to electronically sign the form.

- Insert the date.

- Review the entire electronic document to ensure you have not overlooked anything.

- Click Done and store the new template.

How to modify Get UK HMRC VAT1614J 2020: personalize forms online

Select a dependable document modification service you can rely on. Alter, finalize, and validate Get UK HMRC VAT1614J 2020 securely online.

Frequently, altering documents, such as Get UK HMRC VAT1614J 2020, can prove to be difficult, particularly if you received them in digital format yet lack access to specialized software. Naturally, you might employ some alternatives to navigate this, but you risk producing a form that fails to meet submission criteria. Using a printer and scanner also doesn't offer a solution as it is time-consuming and resource-intensive.

We present a simpler and more efficient method for adjusting files. A broad selection of document templates that are straightforward to personalize and validate, and then render fillable for specific users. Our approach extends far beyond just a collection of templates. One of the most advantageous features of our services is that you can modify Get UK HMRC VAT1614J 2020 directly on our site.

Being an online-based service, it spares you the trouble of needing to acquire any software. Additionally, not all company policies allow you to install it on your work computer. Here's a straightforward way to securely finalize your documents with our solution.

- Click the Get Form > you’ll be instantly redirected to our editor.

- Once opened, you can initiate the editing process.

- Select checkmark or circle, line, arrow and cross, and additional options to annotate your form.

- Choose the date field to add a specific date to your document.

- Insert text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to add fillable {fields.

- Choose Sign from the top toolbar to create and include your legally-binding signature.

- Click DONE and save, print, and distribute or retrieve the document.

Related links form

HMRC might write to you for various reasons, such as clarifying your tax status, requesting information, or notifying you about any due payments. Understanding the context of their correspondence is crucial for compliance. If you are uncertain about the content or implications regarding UK HMRC VAT1614J, consider seeking advice through platforms like US Legal Forms for professional guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.