Loading

Get Za Sars Da 66

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ZA SARS DA 66 online

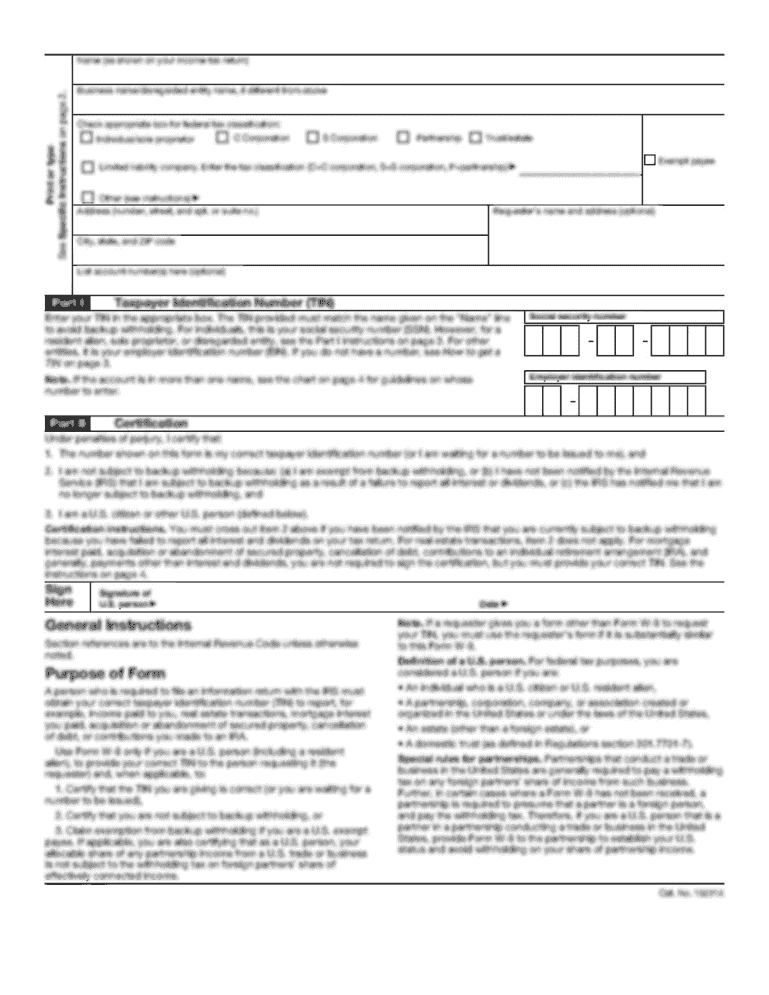

The ZA SARS DA 66 form is essential for claiming refunds related to customs and excise duties in South Africa. This guide provides a clear, step-by-step approach to filling out the form online, ensuring that users can navigate the process with ease and confidence.

Follow the steps to complete the ZA SARS DA 66 form successfully.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Fill in Section A1 with the approval details from the Controller of Customs and Excise, including the alphabetical district office code, name of the refund officer, and their signature.

- In Section A2, provide the claim particulars. This includes the date of receipt and the claim date and number.

- Proceed to Section B1. Here, enter your applicant information. Include your name, code number, address, bank details, and account type.

- In Section B2, indicate whether you are the importer or exporter by marking the appropriate box with an 'X'.

- Complete Section B3, summarizing the amounts being claimed. Specify types of duty or revenue and the corresponding Rand and Cent amounts.

- In Section B4, detail the particulars of the document under which payment was made. Enter the customs declaration CPC, form number, MRN, and payment date.

- Move to Section B5 and select the type of refund by marking an 'X' in the appropriate box.

- Attach the required documentation in Section B6, making sure to list all attached documents clearly.

- Complete Section B7 with your indemnity details and personal information, including a signature.

- Provide a detailed explanation for the claim in Section B8, ensuring all reasons are clear and supported by documentation.

- Complete Section B9 by detailing amounts claimed and related allocation codes.

- Once all sections are filled out, save your changes, and choose to download, print, or share the completed form.

Complete your ZA SARS DA 66 form online now to ensure a smooth claims process.

SARS may send SMS notifications regarding your refund status; however, it's important to verify such communications through your eFiling account. Ensure that your mobile number is correctly registered with your ZA SARS DA 66 profile to receive timely updates. This feature helps keep you informed about the progress of your refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.