Loading

Get Uk Hmrc Vat1614j 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC VAT1614J online

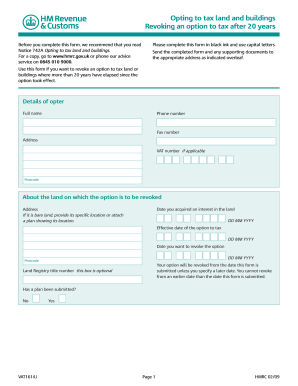

Filling out the UK HMRC VAT1614J form is an essential process for users wishing to revoke an option to tax land or buildings after a period of 20 years. This guide provides step-by-step instructions to help users complete the form accurately and effectively.

Follow the steps to fill out the VAT1614J form

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- In the 'Details of opter' section, provide your full name, phone number, fax number, address, VAT number (if applicable), and postcode.

- Navigate to the section titled 'About the land on which the option is to be revoked.' Fill in the date you acquired an interest in the land, including the specific day, month, and year, and the specific address of the land. If applicable, include a plan showing the location of bare land.

- In the same section, denote the effective date of the option to tax and the date you want to revoke the option. Ensure all dates are filled accurately.

- Check if a land registry title number is applicable, noting that this box is optional. Indicate whether a plan has been submitted by selecting 'Yes' or 'No.'

- Carefully read the 'Conditions for revocation' section, and indicate whether you meet each condition by selecting 'Yes' or 'No.' Be aware of the implications of each condition.

- Complete the declaration section. Indicate if you meet condition 1, and details about conditions 2 to 5. Ensure you answer honestly and mark the appropriate boxes.

- Sign the document, print your name, and provide the date of notification in the section provided. Make sure to choose the status that applies to you.

- If necessary, attach a letter of authority authorizing someone else to submit on your behalf. Answer the final question regarding previously submitted letters of authority.

- Once you have completed filling out the form, you can save the changes, download, print, or share the form as needed.

Complete your VAT1614J form online today and ensure compliance with HMRC regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

HMRC regularly sends letters to keep you informed about your tax responsibilities and any changes that may affect you. This communication can include notices about VAT submissions and updates related to UK HMRC VAT1614J. It is crucial to address these letters promptly to keep your tax matters in good standing and avoid potential penalties.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.