Loading

Get Uk Hmrc Iht422 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC IHT422 online

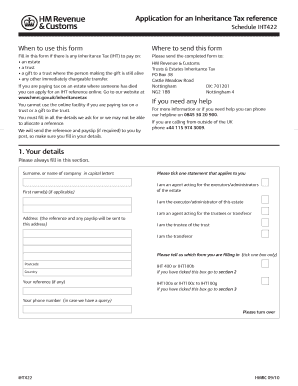

The UK HMRC IHT422 form is essential for reporting any inheritance tax obligations related to an estate, trust, or certain gifts. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete your IHT422 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, titled 'Your details', fill in your surname or company name in capital letters. Indicate which statement applies to you by ticking the appropriate box. Include your first name(s) if applicable, and provide your full address, as this is where your reference and any payslip will be sent.

- Complete the postcode and country information. If you have an existing reference, please include it in the designated field. Tick the box corresponding to the form you are filling in (IHT400 or IHT100b to move to section 2; IHT100a or IHT100c to IHT100g to move to section 3). Include your phone number for any queries.

- In the next section, labeled 'Deceased's details', if applicable, input the deceased's surname in capital letters, their national insurance number (if known), first name(s), and the date of death using the format DD MM YYYY. Include any other names the deceased was known by and the country in which you are applying for probate or confirmation.

- If you are reporting on a trust or a gift to a trust, fill in the 'Name of settlor or transferor' section. Provide the surname in capital letters, first name(s), and indicate what type of event you are reporting by selecting the appropriate box.

- Continue by providing the date of settlement and the date of the event you are reporting. Make sure to document the expected date the IHT100 Inheritance Tax account will be submitted as well.

- After completing all sections, ensure that all information is accurate and saved. You can then download, print, or share the completed form as needed.

Complete your IHT422 form online today for a smooth inheritance tax process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Married couples in the UK can employ several strategies to minimize or avoid inheritance tax. Utilizing the available marriage allowance and combining personal exemptions can be effective. Consider looking into the UK HMRC IHT422 regulations for applicable thresholds and exemptions. Additionally, platforms like uslegalforms can provide helpful resources to devise a personalized plan suited to your circumstances.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.