Loading

Get Uk Hmrc Form 185 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC Form 185 online

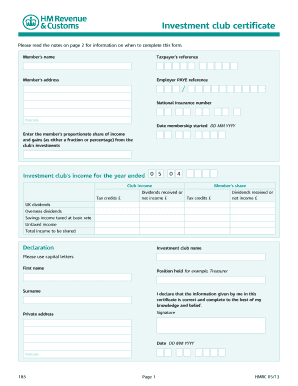

Filling out the UK HMRC Form 185 online is a straightforward process that allows users to declare their share of income and capital gains from investment clubs. This guide provides a comprehensive overview to ensure you accurately complete the form in an efficient manner.

Follow the steps to successfully fill out the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the member's name in the designated field. Ensure that all information is accurate to prevent any issues with your submission.

- Input your taxpayer's reference number in the appropriate section. This helps the HMRC identify your records effectively.

- Fill in the member's address, including the postcode, ensuring all details are correct.

- Provide your employer PAYE reference number and National Insurance number in the given fields.

- Insert the date when your membership started, formatted as DD MM YYYY.

- Detail your proportionate share of income and gains from the club’s investments as either a fraction or percentage.

- Complete the income fields for the investment club for the year ended, including total income, tax credits, and breakdowns for dividends and savings income.

- Make sure to declare your capital gains and losses as well, filling in net sale proceeds and the dates of acquisition and sale.

- Fill in the declaration section, including the investment club name, your first name, surname, private address, and position held in the club.

- Sign and date the form, ensuring the date is in the correct format (DD MM YYYY).

- Review all entries for accuracy before saving your changes. Once complete, you may have the option to download, print, or share the form.

Prepare and complete your documents online to streamline your filing process.

To reclaim your tax when you leave the UK, fill out UK HMRC Form 185, which details your tax status and any refunds due. This form streamlines the process of claiming a refund for overpaid taxes. After submission, HMRC will review your request and issue the refund if applicable. Ensuring you complete this form correctly can expedite the return of your funds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.