Loading

Get Uk Hmrc Ch2 (cs) 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC CH2 (CS) online

Filling out the UK HMRC CH2 (CS) form is an essential step in managing Child Benefit claims for additional children. This guide provides comprehensive instructions to ensure a smooth and accurate submission process.

Follow the steps to fill out the UK HMRC CH2 (CS) online

- Press the ‘Get Form’ button to access the form and open it in your preferred digital format.

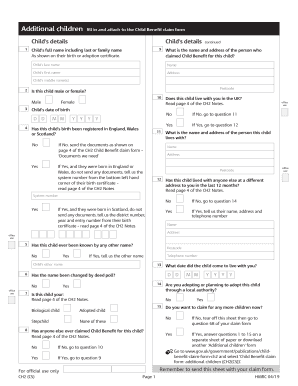

- Enter the child's full name, including their last or family name, as it appears on their birth or adoption certificate.

- Specify the child's gender by indicating either male or female.

- Provide the child’s date of birth in the format day, month, and year.

- Indicate whether the child’s birth has been registered in England, Wales, or Scotland.

- Answer if the child currently resides with you in the UK. If 'No', follow the instructions for documentation as indicated in the CH2 Notes.

- If the child lives with you, provide the name and address of the person who claimed Child Benefit for this child, if different from you.

- Report if the child has lived at any other address in the last 12 months and provide necessary details, if applicable.

- Indicate if the child has ever been known by any other name, and if so, provide that name.

- Describe the relationship of the child to you from the options provided: biological child, adopted child, stepchild, or none of these.

- If you want to claim for any additional children, indicate 'Yes' and provide their details on a separate sheet or by downloading another ‘Additional children’ form.

- Review all entered information for completeness and accuracy before final submission.

- Once completed, you can save changes, download, print, or share the form.

Complete your HMRC CH2 (CS) form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Eligibility for Child Benefit in the UK typically includes anyone responsible for bringing up a child under age 16 or under age 20 if they are in approved education or training. It is important for families to understand the eligibility criteria set out by UK HMRC. You can use resources like uslegalforms to find accurate information and facilitate the application process for Child Benefit.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.