Loading

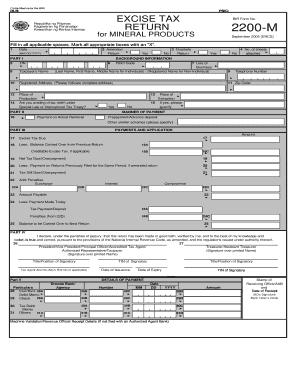

Get Ph Bir Form 2200-m 2005-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR Form 2200-M online

Filing taxes can often be a complex process, but understanding each component of the PH BIR Form 2200-M can simplify it significantly. This guide provides clear steps to help users complete the form online.

Follow the steps to successfully complete your form.

- Click ‘Get Form’ button to obtain the form and access it for online completion.

- Enter your Taxpayer Identification Number (TIN) in the designated field. Ensure that the TIN is accurate to avoid any issues with your submission.

- Fill in your complete name as the taxpayer. For individuals, provide the last name, first name, and middle name. Non-individuals should enter their registered name.

- Provide your registered address, including the zip code and telephone number. It's crucial to ensure these details are correct for any correspondence.

- Indicate the place of production and extraction. If you are availing of tax relief under special law or international tax treaty, mark 'Yes' and specify as needed.

- In Part II, outline the manner of payment — whether it is based on actual removal or prepayment/advance deposit. Select the appropriate option.

- In Part III, accurately list the excise tax details. Start by entering the amount of excise tax due, and detail any credits, payments, or penalties applicable.

- In Part IV, sign the declaration confirming the accuracy of the information provided. Include the TIN of the signatory and their title or position.

- Finally, review all sections of the form for completeness and accuracy. Once verified, you can save changes, download, print, or share the form as needed.

Complete your PH BIR Form 2200-M online for a streamlined filing experience.

BIR Form 2551Q is intended for quarterly percentage tax returns for businesses in the Philippines. This form allows businesses to report their quarterly income and tax obligations accurately. If you're also dealing with forms like the PH BIR Form 2200-M, it's crucial to be aware of your filing requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.