Loading

Get Ph Bir 2338 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 2338 online

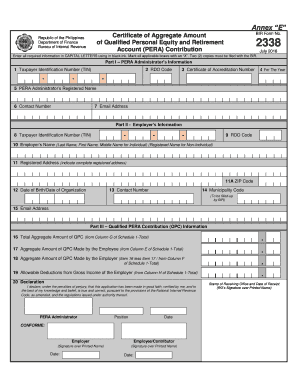

The PH BIR 2338 form is essential for reporting contributions to the Personal Equity and Retirement Account (PERA). This guide will help you navigate the online completion of this form with clarity and ease.

Follow the steps to complete the PH BIR 2338 online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering the PERA administrator's information in Part I. Fill in the Taxpayer Identification Number (TIN) and RDO Code, followed by the Certificate of Accreditation Number, the year, the PERA administrator’s registered name, contact number, and email address.

- Proceed to Part II, which requires the employer’s information. Provide the employer's TIN and RDO Code, followed by the employer's name in the specified order: last name, first name, and middle name. Include the complete registered address and ZIP code, date of birth or date of organization, contact number, municipality code, and email address.

- In Part III, you will enter information regarding Qualified PERA Contributions (QPC). Start with the total aggregate amount of QPC, followed by the amounts made by the employee and employer. Fill in the allowable deductions from the employer's gross income.

- Complete the declaration section reaffirming the truthfulness of the application. Ensure that both the PERA administrator and employer sign with printed names, including dates.

- Finally, you can save your changes, download, print, or share the form as needed.

Complete your BIR documents online to streamline your filing process.

Yes, you can amend your tax return even after filing. Use the PH BIR 2338 form to reflect the changes needed on your return. Simply follow the writ large process and submit it to the appropriate BIR office. This option allows you to correct mistakes and ensure accurate tax records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.