Get Estate Tax Return Checklist Of Documentary Requirements

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Estate Tax Return Checklist Of Documentary Requirements online

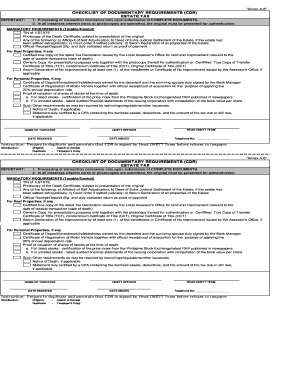

Completing the Estate Tax Return Checklist of Documentary Requirements is a critical step in fulfilling your estate tax obligations. This guide will provide you with clear, step-by-step instructions on how to navigate the online form effectively, ensuring you submit all necessary documentation accurately and on time.

Follow the steps to complete your Estate Tax Return Checklist online.

- Click ‘Get Form’ button to obtain the form and open it in the editing environment.

- Begin by entering the TIN of the estate in the designated field. Ensure that this information is accurate as it is essential for processing your return.

- Upload a photocopy of the death certificate. Remember to have the original document available for authentication when required.

- Select and provide any of the following supporting documents: Affidavit of Self Adjudication, Deed of Extra-Judicial Settlement of the Estate, Court order for judicial settlements, or a Sworn Declaration of all properties of the estate.

- Submit the official receipt or deposit slip along with a duly validated return as proof of payment; this is mandatory for processing.

- If applicable, detail information regarding real properties owned by the estate. Attach a certified true copy of the latest Tax Declaration from the Local Assessor's Office.

- Include the owner's copy of property documents for presentation and a photocopy for authentication, such as a Transfer Certificate of Title (TCT) or Original Certificate of Title (OCT).

- For personal properties, provide a Certificate of Deposit/Investment or Indebtedness signed by the bank manager. Additionally, include the Certificate of Registration of Motor Vehicle along with the acquisition cost for depreciation purposes.

- Submit proof of stock valuation at the time of death through the required documents based on whether the stocks are listed or unlisted.

- Attach any additional requirements as specified by law or relevant regulations.

- If applicable, include a Notice of Death, and ensure that a statement certified by a CPA detailing itemized assets, deductions, and tax due is submitted.

- Review all information entered for accuracy. Once satisfied, save your changes to the form.

- After completing your review, you may download, print, or share the completed form as required.

Begin filling out your Estate Tax Return Checklist online today to ensure timely compliance with estate tax requirements.

To avoid taxes on executor fees, it is vital to understand the legal options available for structuring these fees. Seeking advice from a tax professional can provide clarity on permissible deductions and strategies. Utilizing the Estate Tax Return Checklist Of Documentary Requirements allows you to properly document and potentially minimize the taxable amount.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.