Get Nz Work And Income Iss26w Form 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NZ Work and Income ISS26W Form online

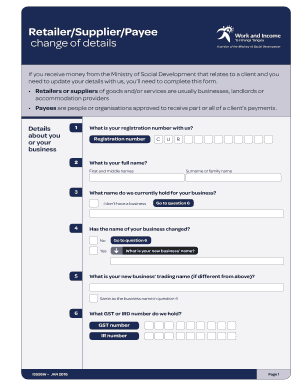

Filling out the NZ Work and Income ISS26W Form online is an essential step for updating your details if you are a retailer, supplier, or payee receiving payments from the Ministry of Social Development. This guide will provide you with clear and detailed instructions to assist you in completing the form accurately and efficiently.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the ISS26W Form and open it for completion.

- Enter your registration number in the designated field. This is your unique identifier with the Ministry of Social Development.

- Provide your full name, including your first and middle names, as required.

- Indicate the name currently held for your business, or select 'I don’t have a business' if applicable.

- If your business name has changed, select 'Yes' and provide the new business name and trading name in the appropriate fields. If not, select 'No' and proceed.

- Enter your GST or IRD number as recorded by the Ministry. If your number is changing, be prepared to provide the new GST and IR number.

- Describe the main type of goods or services you provide, selecting the most appropriate option from the list.

- If applicable, provide details about your EFTPOS services by answering the relevant questions and attaching the required merchant logon receipt.

- Indicate if your bank account information has changed, if so, provide the name and account number for payment transfers.

- Complete your contact details, including your street address, mailing address (if different), and information for a contact person.

- Read and agree to the declaration by entering your printed name, signature, and date of submission.

- Review the checklist to ensure all required documents, such as merchant logon receipts and proof from your bank, are attached.

- Once all sections are filled out and documents attached, save your changes, download, print, or share the completed form as needed.

Complete your documents online to ensure your payment details are updated without delay.

The amount a single person receives on the benefit in NZ depends on various factors, including individual circumstances and the specific type of benefit. Generally, the amount is designed to support living expenses. For detailed calculations, consider consulting with Work and Income NZ directly or review the information when filling out the NZ Work and Income ISS26W Form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.