Loading

Get Nz Ir 196 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NZ IR 196 online

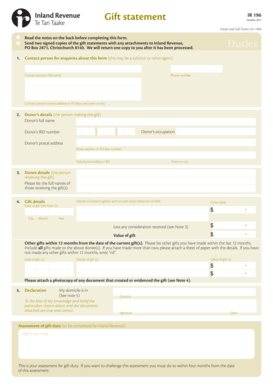

The NZ IR 196 form, also known as the gift statement, is a crucial document required for reporting gifts made that exceed certain thresholds. This guide will provide you with clear, step-by-step instructions on how to complete the form online, ensuring a smooth and accurate filing process.

Follow the steps to complete the NZ IR 196 form online.

- Click the ‘Get Form’ button to access the gift statement and open it in the editor. This step is essential to start your filing.

- Enter the contact person's details for enquiries about this form. Provide their full name, phone number, and street address or PO Box along with the town or city.

- Fill in the donor’s details, which include the donor's full name, occupation, IRD number, and postal address. Make sure to include the street address or PO Box number, suburb, and box lobby or rural delivery (RD) information.

- List the donee's details. Clearly specify the full names of the individuals receiving the gift(s).

- Provide the gift details. Include the town or city where the gift is located, a description of the property gifted (such as cash, land, or reduction of debt), and the date of the gift. Be sure to record the gross value and any consideration received, then calculate the final value of the gift.

- Include any other gifts made within the last 12 months to the same donee(s). List the dates, details, and values of these gifts. If there are more than two, attach an additional sheet with the necessary information.

- Indicate the country of your domicile as part of the form and certify that the particulars provided are true and correct. Sign and date the form to finalize your submission.

- After completing the form, you will have options to save your changes, download the completed gift statement, print it for your records, or share it as needed.

Take the next step and complete your NZ IR 196 gift statement online today.

Resident withholding tax in New Zealand is a tax deducted from certain types of income, such as interest and dividends for residents. This tax ensures that income is taxed at the source before it reaches the taxpayer. Being aware of resident withholding tax and its details in relation to the NZ IR 196 can help you manage your finances better.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.