Loading

Get India Form 45c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India Form 45C online

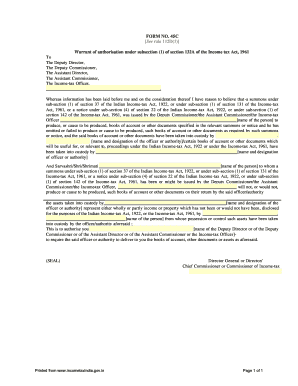

Filling out the India Form 45C is an important process that involves authorizing officials to request and retrieve essential documents relevant to income tax proceedings. This guide will walk you through the steps necessary to complete this form accurately and submit it online.

Follow the steps to fill out the India Form 45C online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing the name of the relevant officer to whom the form is addressed, selecting from 'Deputy Director', 'Deputy Commissioner', 'Assistant Director', 'Assistant Commissioner', or 'Income-tax Officer'.

- In the designated section, include the name of the person to whom a summons or notice has been issued, as well as their designation.

- Specify the details of the summons or notice that was issued under the respective sections of the Income-tax Act, ensuring that you include the appropriate sub-section references.

- Enter the name and designation of the officer or authority who has taken custody of the required documents or assets.

- Clarify whether the assets mentioned represent income or property that has not been disclosed as per the regulations of the Income-tax Act.

- Conclude the form by detailing the authority you wish to grant, specifically providing the name of the officer who will handle the requisite documents or assets.

- Review all the entered information for accuracy and completeness before finalizing the form.

- Once you are satisfied, save the changes and choose to download, print, or share the completed form as needed.

Ensure your tax filings are complete by submitting your India Form 45C online.

To apply for a Tax Clearance Certificate (TCC) online in India, visit the official Income Tax Department website. Complete the online application by providing necessary details and uploading required documentation. Understanding the application process, including how it relates to forms like the India Form 45C, can help you achieve your tax compliance goals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.