Get India Form 3ck

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India Form 3CK online

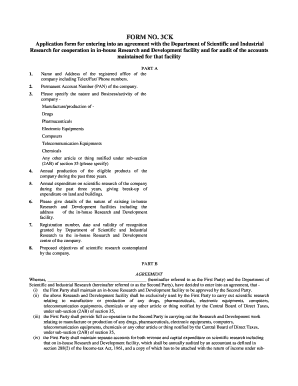

Filling out the India Form 3CK is essential for companies seeking to establish a partnership with the Department of Scientific and Industrial Research for their in-house research and development. This guide provides clear instructions on how to complete the form accurately and efficiently, ensuring compliance with necessary requirements.

Follow the steps to fill out the India Form 3CK online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name and address of the registered office of the company, including contact numbers such as Telex, fax, and phone.

- Provide the Permanent Account Number (PAN) of the company.

- Specify the nature and business activity of the company by selecting from the options provided, which include manufacturing sectors and any other relevant activities.

- List the annual production of eligible products for the past three years, detailing quantities produced each year.

- Indicate the annual expenditure on scientific research over the past three years, clearly breaking down the expenses related to land and buildings.

- Describe the in-house research and development facilities by providing details, including the address of each facility.

- Enter the registration number, date, and validity of recognition granted by the Department of Scientific and Industrial Research to the in-house research and development center.

- Outline the proposed objectives of the scientific research that the company plans to undertake.

- In the agreement section, ensure to agree to the necessary terms, including maintaining separate accounts for scientific research.

- Sign and date the form at the end where indicated, ensuring all required signatures are obtained.

- Finally, users can save changes, download, print, or share the completed form as needed.

Complete your India Form 3CK online today to ensure your research and development initiatives are recognized.

Once you receive the employee's withholding allowance certificate, keep it securely for your records. This certificate is crucial for calculating payroll taxes and determining the appropriate amount to withhold from the employee's paychecks. It’s important to refer to the India Form 3CK to ensure compliance and accuracy in reporting.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.