Get India Form 307

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India Form 307 online

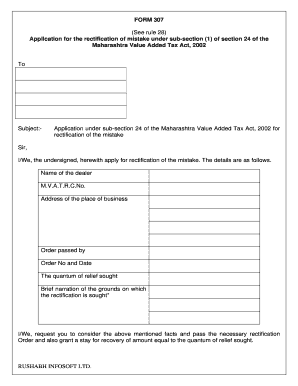

Filling out the India Form 307 is an essential process for individuals seeking rectification of mistakes under the Maharashtra Value Added Tax Act, 2002. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the India Form 307 online

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your name in the 'Name of the dealer' field. Ensure that the name matches the official registration documents.

- Provide your M.V.A.T.R.C. number in the designated field. This number is important for identification purposes in the tax system.

- Fill in the address of your place of business accurately. Include all relevant details to avoid processing delays.

- In the section labeled 'Order passed by', include the name of the authority that issued the order. This is crucial for the rectification request.

- Input the Order Number and the date of the order in the respective fields to clarify which order you are referencing in your application.

- Specify the quantum of relief sought in the mentioned section. This should reflect the exact amount needing rectification.

- Provide a brief narration of the grounds on which the rectification is sought. Be detailed and clear to support your request effectively.

- If necessary, annex a separate page for additional explanations or details regarding your application.

- Review all entered information for accuracy. Once verified, proceed to save your changes.

- Upon reviewing, download the completed form, print it, or share it as necessary for submission.

Complete your documents online today to ensure timely rectification and compliance.

Filling in Form 10F in India involves entering specific details like your name, address, and the country of your tax residency. Ensure that you provide accurate information regarding the nature of your income and the relevant tax treaty benefits. Carefully review the completed form before submission, as any discrepancies can lead to delays or denial of treaty benefits. If you need assistance, platforms like USLegalForms can simplify the process for you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.