Get Ie Sarp Employer Return 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE SARP Employer Return online

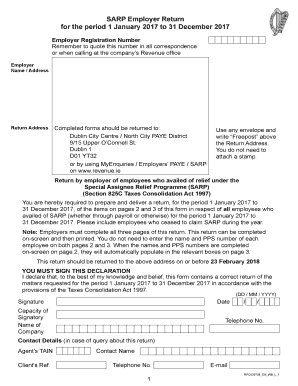

The IE SARP Employer Return is a crucial document for employers who have employees benefitting from the Special Assignee Relief Programme. This guide provides step-by-step instructions on how to accurately complete the return online, enabling you to fulfill your obligations efficiently.

Follow the steps to complete your IE SARP Employer Return online.

- Press the ‘Get Form’ button to access the IE SARP Employer Return and open it in your chosen editor.

- Enter your employer registration number at the top of the form. This number is essential for all correspondence with the Revenue office.

- Fill in your name and address, followed by the return address where completed forms should be submitted.

- Complete all three pages of the form, ensuring that you include details for all employees who availed of SARP during the specified period, including those who ceased claiming relief.

- On page 2, enter the names and PPS numbers of the employees availing of SARP relief. Note that these entries will populate automatically on page 3.

- For each employee, provide their job title, a brief description of their role, and tick the box indicating if this is the first year they are claiming relief under SARP.

- Report income details, including the gross income from employment (before SARP deductions), any school fees claimed, and costs associated with the relief.

- Detail the increase in employees due to SARP and the number of employees retained as a result of its operation in the provided fields.

- Once completed, review the entire form for accuracy, then save your changes. You can also download, print, or share the form as needed.

Complete your IE SARP Employer Return online today to meet your filing requirements.

Get form

The 4 year rule in Ireland often refers to the time frame for capital gains tax relief for certain disposals. Under this rule, you may qualify for relief on gains made if you have owned the asset for a minimum of four years. Understanding how this impacts your investment strategy is essential for effective financial management. To assist you in understanding these provisions, the USLegalForms platform offers information to help with your IE SARP Employer Return.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.