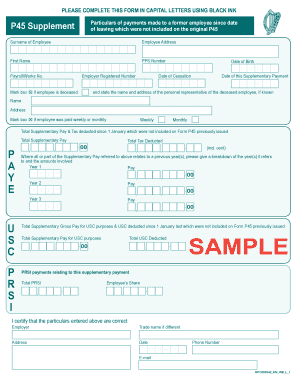

Get P45 Example

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P45 Example online

Filling out the P45 Example online is a straightforward process that ensures accurate reporting of supplementary payments made to a former employee. This guide provides step-by-step instructions to help you complete the form correctly and efficiently.

Follow the steps to complete the P45 Example form online.

- Press the ‘Get Form’ button to access the P45 Example form and open it for editing.

- Begin by entering the surname of the former employee in the designated field, using capital letters as instructed.

- Fill in the employee's address, ensuring that all details are complete and accurate.

- Input the employee's first name and their PPS number in the corresponding fields.

- Record the employee's date of birth in the format D D M M Y Y.

- Provide the payroll or works number for reference.

- Enter the employer's registered number.

- Indicate the date of cessation of employment.

- Note the date of the supplementary payment that is being reported.

- If applicable, mark the box indicating if the employee is deceased and provide the name and address of their personal representative.

- Indicate the payment frequency by marking the relevant box for either weekly or monthly payments.

- Calculate and enter the total supplementary pay and tax deducted since January that were not reported on the previous Form P45.

- If the supplementary payment relates to prior years, list the years and the respective amounts broken down.

- Complete the section detailing total supplementary gross pay for USC purposes and the associated deductions.

- Provide details of the total PRSI payments related to the supplementary payment.

- Finish by certifying the accuracy of the information by entering the employer's name, trade name (if different), address, date, phone number, and email.

- Once all fields are completed, save your changes, download, print, or share the form as necessary.

Complete your P45 Example form online today for accurate and timely processing.

When you leave a job, you should keep your P45 in a safe place, as it contains important tax information. You will need to send the P45 to your new employer or the tax office if you start working elsewhere to ensure proper tax deductions. Additionally, retaining a copy for your records can be helpful during tax season or future employment situations. For more guidance and a P45 example, visit US Legal Forms to access various resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.