Loading

Get Canada Td1 E 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada TD1 E online

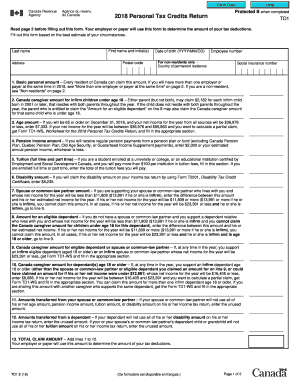

Filling out the Canada TD1 E form is an essential step for ensuring the correct tax deductions by your employer or payer. This guide provides clear instructions to help you complete the form accurately, especially when filing online.

Follow the steps to successfully complete the Canada TD1 E form.

- Press the ‘Get Form’ button to obtain the TD1 E form, which you can then open in your digital document editor.

- Begin by entering your personal information at the top of the form, including your last name, first name, and initial(s), address, postal code, date of birth, employee number, and social insurance number.

- Indicate your country of permanent residence if you are a non-resident, noting that this section is only for non-residents of Canada.

- Proceed to fill out the claim amounts based on your eligibility, starting with the basic personal amount, followed by other credits that apply to your situation such as the Canada caregiver amount or the disability amount.

- Make sure to check the relevant boxes regarding multiple employers or total income; if you have more than one employer, claim the appropriate deductions accordingly.

- If applicable, fill in any deductions related to living in a prescribed zone and any additional tax amounts you want to be deducted from each payment.

- Before submitting, carefully review all the information provided to ensure accuracy. Sign and date the form to certify the correctness of your information.

- Once completed, save the changes and download the document. You can print or share the completed form as needed.

Complete your taxes and manage your documents efficiently by filing the Canada TD1 E online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The 90% rule for newcomers in Canada relates to tax obligation, requiring you to remit at least 90% of your tax owing to avoid incurring penalties. This rule is crucial during your initial years in the country, ensuring you remain compliant with local regulations. Leveraging resources like the Canada TD1 E can guide you in navigating your taxes effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.