Loading

Get Canada T2 Sch 125 E 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2 SCH 125 E online

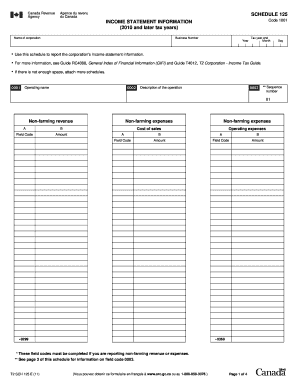

The Canada T2 SCH 125 E form is essential for reporting a corporation's income statement information. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the Canada T2 SCH 125 E online.

- Click the ‘Get Form’ button to obtain the form and open it in the designated online platform.

- Begin by entering the name of the corporation in the designated field at the top of the form.

- Input your Business Number, followed by the tax year and the year-end month and day.

- In the section for income statement information, provide details for non-farming revenue, including amounts, and complete the relevant field codes.

- Proceed to enter non-farming expenses, including cost of sales and operating expenses, filling out the required field codes.

- If applicable, indicate farming revenue and expenses, ensuring to report all necessary amounts and fill the bolded field codes.

- Continue to report extraordinary items and income taxes, completing the respective field codes as outlined.

- Review the form for any additional schedules that may need to be attached if there is not enough space.

- Once all sections are completed, save your changes, and consider downloading, printing, or sharing the form as needed.

Ready to start? Fill out your Canada T2 SCH 125 E online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Current estimates suggest that approximately 10% of Canadians earn more than $100,000 annually. This income threshold plays a significant role in determining tax brackets and financial planning. Understanding where this percentage fits can help individuals prepare their taxes smartly using resources like the Canada T2 SCH 125 E.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.