Get Canada Nr5 E 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada NR5 E online

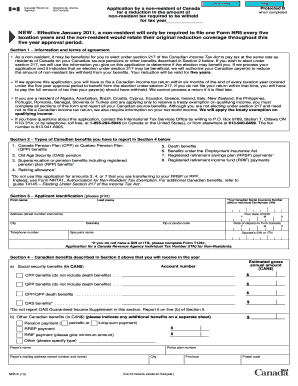

Filling out the Canada NR5 E form online is essential for non-residents of Canada seeking to reduce the withholding tax on their eligible Canadian-source benefits. This guide will provide you with step-by-step instructions to complete the form accurately and efficiently.

Follow the steps to fill out the Canada NR5 E form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section 1, carefully read the information and terms of agreement. Acknowledge the benefits of electing under section 217, if applicable, and potential obligations related to tax filing.

- In Section 2, identify the types of Canadian benefits you will be reporting. List all applicable benefits such as Canada Pension Plan (CPP) and Old Age Security (OAS).

- For Section 3, provide your identification information. Fill in your last name, first name, Canadian Social Insurance Number (SIN) or Individual Tax Number (ITN), address, date of birth, date of departure from Canada, and your telephone number.

- In Section 4, detail the Canadian benefits you are estimated to receive in the year. Include specific amounts for each type of income you are anticipating, making sure to follow any specific instructions provided.

- Proceed to Section 5 where you will report your net world income information. Provide estimated amounts for other Canadian-source income and income from sources outside Canada, if applicable.

- In Section 6, answer questions related to non-refundable tax credit information. This includes confirming support for dependants, disability information, and tuition fees paid.

- If necessary, fill out Section 7 with dependent information based on previous answers in Section 6. Make sure to provide details for each dependent.

- Finally, in Section 8, certify that all information is correct by signing and dating the form. If you are signing on behalf of someone else, include the necessary power of attorney documentation.

- Review your completed form meticulously. Once satisfied, you can save changes, download, print, or share the completed document as required.

Complete your Canada NR5 E form online today and ensure you receive the appropriate tax reductions.

Get form

The NR5 tax form for Canada is a document used by non-residents to apply for a reduction or refund of withholding tax on certain types of income. This form allows you to manage your tax obligations effectively while staying compliant with Canadian law. If you are engaging with Canadian sources of income, understanding the NR5 form will be beneficial. You can find more information and assistance on platforms like UsLegalForms to ensure accurate completion.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.