Loading

Get Canada Sc Isp-1401 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada SC ISP-1401 online

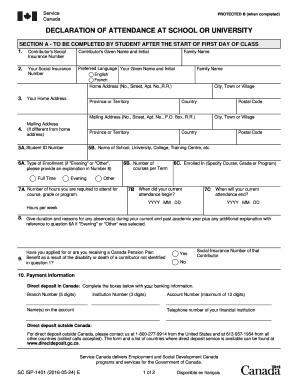

Filling out the Canada SC ISP-1401 form is an important step in declaring your attendance at school or university for the Canada Pension Plan. This guide provides clear, step-by-step instructions to ensure that you complete the form accurately and efficiently when filing online.

Follow the steps to successfully complete the Canada SC ISP-1401 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the contributor's social insurance number (SIN) in the first field, followed by their given name and initial.

- Enter your own social insurance number, preferred language (English or French), your given name and initial, and family name.

- Provide your home address, including number, street, apartment number (if applicable), city, province or territory, and postal code.

- If your mailing address is different from your home address, complete the relevant fields with that information.

- Enter your student ID number, the name of your school, university, college, or training center, and specify your type of enrollment (full-time, evening, or other). If you select 'Evening' or 'Other,' provide a brief explanation in the designated field.

- Indicate the number of hours you are required to attend your course, as well as when your attendance began and when it is expected to end.

- Describe any absence during the current and past academic year, including duration and reasons, and provide additional explanations if applicable.

- Indicate whether you have applied for or are receiving a Canada Pension Plan benefit as a result of a contributor's disability or death. If yes, provide the contributor’s social insurance number.

- Fill in your payment information if you wish to set up direct deposit, including branch number, institution number, name(s) on the account, and account number.

- Review all information entered for accuracy. Ensure your signature is included and date the application.

- Once you have completed and reviewed the form, you can save your changes, download the document, print it, or share it as required.

Complete your Canada SC ISP-1401 form online today to ensure your attendance is properly declared.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can still collect your Canada Pension Plan (CPP) benefits even if you live outside of Canada. However, you may have to provide specific documentation and ensure that your payments are deposited into a recognized account. Exploring the Canada SC ISP-1401 details can offer additional insights into international pension collection and requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.