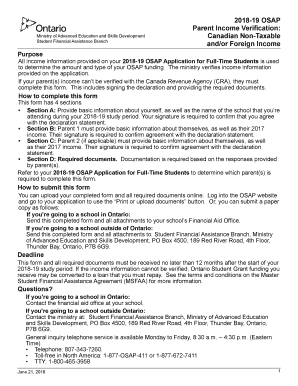

Get Canada Osap Parent Income Verification: Canadian Non-taxable And/or Foreign Income 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Canada OSAP Parent Income Verification: Canadian Non-Taxable and/or Foreign Income online

How to fill out and sign Canada OSAP Parent Income Verification: Canadian Non-Taxable and/or Foreign Income online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

The preparation of legal documents can be costly and time-consuming. However, with our ready-made templates, everything becomes easier.

Now, processing a Canada OSAP Parent Income Verification: Canadian Non-Taxable and/or Foreign Income takes no more than 5 minutes. Our state-of-the-art web-based forms and straightforward instructions eliminate human errors.

Utilize the rapid search and advanced cloud editor to produce an accurate Canada OSAP Parent Income Verification: Canadian Non-Taxable and/or Foreign Income. Eliminate the monotony and create documents online!

- Select the template from the library.

- Enter all necessary details in the required fillable fields. The user-friendly drag-and-drop interface allows for easy addition or movement of sections.

- Ensure that everything is correctly filled out, free of typos or missing fields.

- Place your electronic signature on the document.

- Click Done to finalize the changes.

- Download the documents or print your PDF version.

- Submit it directly to the recipient.

How to Alter Get Canada OSAP Parent Income Verification: Canadian Non-Taxable and/or Foreign Income 2018: Customize forms online

Completing documentation is more straightforward with intelligent online solutions. Remove paperwork with easily downloadable Get Canada OSAP Parent Income Verification: Canadian Non-Taxable and/or Foreign Income 2018 templates that you can modify online and print.

Organizing files and records needs to be more effortless, whether it is a routine part of one’s job or occasional duties. When an individual must submit a Get Canada OSAP Parent Income Verification: Canadian Non-Taxable and/or Foreign Income 2018, researching rules and instructions on how to fill out a form accurately and what it should encompass can consume considerable time and effort. Nevertheless, if you locate the appropriate Get Canada OSAP Parent Income Verification: Canadian Non-Taxable and/or Foreign Income 2018 template, finalizing a document will cease to be a challenge with an intelligent editor available.

Uncover a wider variety of features you can incorporate into your document workflow. There's no need to print, fill out, and annotate forms by hand. With a smart editing platform, all necessary document processing features are always accessible. If you aim to enhance your work process with Get Canada OSAP Parent Income Verification: Canadian Non-Taxable and/or Foreign Income 2018 forms, search for the template in the catalog, select it, and find a simpler method to complete it.

The more tools you master, the easier it becomes to work with Get Canada OSAP Parent Income Verification: Canadian Non-Taxable and/or Foreign Income 2018. Explore the solution that provides everything essential to locate and modify forms in a single browser tab and eliminate manual paperwork.

- If you need to include text in any section of the form or add a text field, use the Text and Text field tools and enlarge the content in the form as needed.

- Employ the Highlight tool to emphasize significant sections of the form. If you need to hide or delete some text parts, use the Blackout or Erase tools.

- Personalize the form by inserting default graphic elements. Use the Circle, Check, and Cross tools to incorporate these elements into the forms when feasible.

- If you require extra notes, utilize the Sticky note function and add as many notes on the forms page as needed.

- If the form requires your initials or date, the editor has tools for that as well. Minimize the chance of mistakes by using the Initials and Date tools.

- It's also easy to insert custom visual elements into the form. Use the Arrow, Line, and Draw tools to personalize the document.

Get form

The exemptions on foreign income often depend on international tax treaties, which a tax advisor can clarify for you. Common exemptions might include pensions, certain dividends, and other specific income types. For Canada OSAP Parent Income Verification: Canadian Non-Taxable and/or Foreign Income, having a clear understanding is vital to making informed decisions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.