Get Canada Cibc 8393 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada CIBC 8393 online

This guide provides clear, step-by-step instructions on completing the Canada CIBC 8393 form online. Designed to assist users with varying levels of experience, this guide will ensure a smooth and effective process for filling out the RESP withdrawal form.

Follow the steps to accurately complete the Canada CIBC 8393 form.

- Click 'Get Form' button to access the Canada CIBC 8393 RESP withdrawal form and open it in your preferred editor.

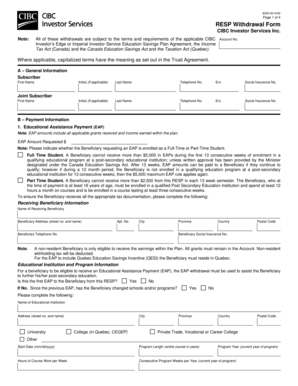

- Begin with section A: General Information. Fill in the first name, initial (if applicable), last name, telephone number, extension, and social insurance number for both the subscriber and joint subscriber as applicable.

- Proceed to section B: Payment Information. Here, you can request the Educational Assistance Payment (EAP) amount and specify whether the beneficiary is enrolled as a full-time or part-time student. Fill in the requested EAP amount and ensure to understand the limitations imposed on full-time and part-time students.

- Complete the Receiving Beneficiary Information. Provide the name, address, telephone number, and social insurance number of the receiving beneficiary. Ensure this information is accurate, as it is essential for tax documentation.

- Fill in the Educational Institution and Program Information to assess eligibility for EAP payments. Confirm if this is the beneficiary's first EAP from this RESP and complete the relevant sections regarding the educational institution's name, address, program start date, and details of the course.

- Choose Payment Options for the EAP. Specify whether the payment is made to the beneficiary or subscriber and acknowledge the tax implications that apply.

- If applicable, indicate if you are terminating the plan in this step. Understand the implications this has on government assistance.

- For Refund of Contributions (ROC), specify whether the withdrawal is for post-secondary educational purposes or non-educational purposes. Complete corresponding sections based on the selected option.

- Complete the Accumulated Income Payment (AIP) section only if an AIP is to be processed. Ensure that all eligibility criteria are considered before proceeding.

- Fill out the Payment Method section, deciding where the funds should be forwarded, such as to the beneficiary's mailing address or the educational institution.

- Complete section D: Declaration. Sign and date the form, ensuring all information provided is complete and accurate.

- Once all sections are completed and double-checked for accuracy, you can save the changes, download, print, or share the form as needed.

Complete your Canada CIBC 8393 form online today for a hassle-free submission experience.

Canada CIBC 8393 primarily serves customers within Canada. However, CIBC does have some operations and partnerships that allow them to assist clients in various international locations. If you're looking for specific services while abroad, it's best to check their official website or contact customer support for detailed information. They ensure accessibility for Canadian citizens, wherever they might be.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.