Loading

Get Canada Cts3711 - Alberta 2008-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada CTS3711 - Alberta online

The Canada CTS3711 form is essential for individuals seeking to vary child support in Alberta. This comprehensive guide will provide you with step-by-step instructions on how to fill out the form online effectively.

Follow the steps to complete the Canada CTS3711 form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

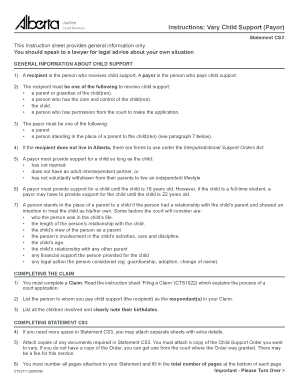

- Read the general information about child support listed in the beginning of the document to understand your roles as a recipient or payor.

- Complete the Claim section by listing the respondent(s), which is the individual to whom you pay child support, and include all involved children along with their birthdates.

- In Statement CS3, if you require more space, feel free to attach additional sheets with more details.

- Attach all required documents, including a copy of the Child Support Order you wish to vary. If you do not have this, obtain it from the court where it was issued.

- Number all pages you attach to your Statement and indicate the total number of pages at the bottom of each one.

- Use this section to provide details about your situation and explain how circumstances have changed since the last Child Support Order.

- Clearly articulate the changes that have occurred, such as any modifications to your financial position or changes in the recipient’s financial situation.

- If applicable, provide specific details regarding the children’s individual circumstances, like special expenses or different living arrangements.

- Describe any special expenses related to the children as laid out in section 7 of the Alberta Child Support Guidelines.

- Supply all necessary financial information to substantiate your income; consider redacting sensitive information.

- If needed, write a request for financial information from the recipient and allow them 30 calendar days to respond.

- Utilize appropriate forms for requesting financial information, such as the Request for Financial Information or a Notice to Disclose.

- Include any financial details you have regarding the recipient to support your claims.

- Attach calculations that validate the amount of child support you propose to pay, and seek assistance if necessary.

- When asking to reduce arrears, submit tax returns for the relevant years and offer reasons for your request.

- Ensure that you serve all documents to the recipients as required.

- If applicable, serve the Director of Maintenance Enforcement if the recipient has ever received financial assistance from the government.

Start completing your Canada CTS3711 form online today to ensure proper handling of your child support variation.

Yes, you can file a Canadian tax return online, which is a convenient option for many, including newcomers under Canada CTS3711 - Alberta. The Canada Revenue Agency (CRA) offers various online platforms to complete your return. Utilizing these online services simplifies the process and provides quick confirmation of your tax filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.