Loading

Get Ed Loan Discharge Application: False Certification (ability To Benefit) 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ED Loan Discharge Application: False Certification (Ability to Benefit) online

The ED Loan Discharge Application for False Certification (Ability to Benefit) is designed for individuals seeking to discharge their federal student loans due to reasons related to eligibility. This guide will provide a clear and supportive walkthrough of the application process.

Follow the steps to complete the application successfully.

- Press the ‘Get Form’ button to access the document online and open it in the editor.

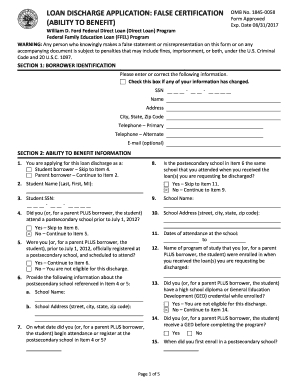

- In Section 1, provide your borrower identification information, including your Social Security Number, name, address, contact numbers, and optional email. Ensure accuracy and check the box if any information has changed.

- Proceed to Section 2, where you will answer questions regarding your eligibility and background as a borrower. Specify whether you are a student or parent borrower and provide information about the postsecondary school you attended.

- Fill in details such as the school name, address, and dates of attendance. Answer questions about your academic status and prior credentials, ensuring you provide all necessary information accurately.

- Continue by answering specific questions about your academic progress, including whether you took an entrance examination and whether you completed required coursework.

- In Section 3, read and certify your agreement to the terms and conditions outlined regarding the loan discharge. Sign and date the form to validate your application.

- Review all completed sections for accuracy before finalizing your form. If you need more space to provide answers, continue on separate sheets, ensuring to attach them securely.

- Submit the completed form and any required documentation to the U.S. Department of Education at the address provided in Section 7. Options to save changes, download, or print the form may be available.

Complete your application online today to start the discharge process.

Related links form

Discharged student loans may not directly increase your credit score; however, they can improve your financial situation. When your loans are discharged, you relieve yourself of debt obligations, leading to a better credit utilization ratio. As you enhance your financial health post-discharge, consider monitoring your credit score for positive changes over time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.