Get Dd 2058-1 1980-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DD 2058-1 online

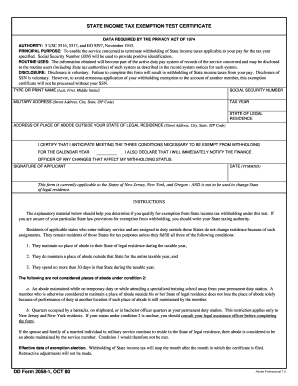

The DD 2058-1 form is essential for military personnel seeking to apply for a state income tax exemption. Completing this form accurately is crucial to terminate the withholding of state income taxes applicable to your pay for specified tax years.

Follow the steps to fill out the DD 2058-1 correctly.

- Press the ‘Get Form’ button to access the DD 2058-1. This will enable you to open the document in an editable format.

- Carefully enter your full name in the designated field as 'Type or print name (Last, First, Middle Initial)'. Make sure to provide accurate details to avoid any processing issues.

- In the ‘Social Security Number’ field, input your SSN. This is necessary for positive identification and processing of the exemption certificate.

- Fill in your complete military address, including street address, city, state, and ZIP code. Accuracy is vital for proper communication regarding your exemption.

- Specify the tax year for which you are requesting the exemption in the 'Tax Year' field.

- Indicate your state of legal residence. This should reflect the state where you hold tax obligations.

- If applicable, provide the address of your place of abode outside your state of legal residence. Include the street address, city, state, and ZIP code.

- Review the conditions necessary to qualify for exemption from withholding. Ensure you meet all three conditions outlined in the instructions.

- Certify your acknowledgment by signing in the 'Signature of Applicant' field and date the form in the 'Date (YYMMDD)' section.

- Once all fields are completed, save your changes. You may choose to download, print, or share the DD 2058-1 form as needed.

Complete the DD 2058-1 online to ensure your state tax withholding is properly managed.

As a military spouse, factors that establish your residency in a state include your marriage to a service member, your location during their service, and your intent to remain in that state. Additionally, filing the DD 2058-1 with your updated residency can help solidify your status. Regularly reviewing and updating this information can provide you with stability and access to local benefits. It’s important to assess your situation to maintain compliance and clarity.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.