Get Sba Form 2483 2000-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sba Form 2483 online

Filling out the Sba Form 2483 online can be a straightforward process when you have the right guidance. This guide provides detailed, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully complete your Sba Form 2483 online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

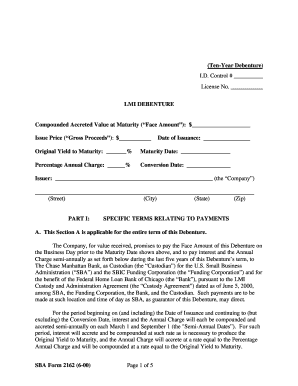

- Begin with the identification section. Fill in the I.D. Control number and License number accurately, as these are vital for the processing of your form.

- Enter the Compounded Accreted Value at Maturity, which represents the face amount of the debenture. Ensure the figure is correct as this will impact future calculations.

- Fill in the Issue Price, which includes the gross proceeds of the debenture. This is essential for your financial records.

- Document the Date of Issuance, ensuring it reflects the accurate date when the debenture was issued.

- Specify the Original Yield to Maturity. This percentage is critical for determining the overall returns associated with the debenture.

- Set the Maturity Date, which indicates when the debenture will mature and the repayment is due.

- Insert the Percentage Annual Charge that applies. This rate is important for understanding the cost associated with the debenture.

- Complete the Conversion Date, which is significant for understanding the timeline of debenture terms.

- Fill out the Issuer information by providing the Company name, street address, city, state, and zip code accurately.

- Review all entered information for accuracy before proceeding to the next steps.

- Once all necessary fields are filled, save your changes. You may then choose to download, print, or share the form as needed.

Take the next step by completing your Sba Form 2483 online to ensure your application is submitted smoothly.

Ineligibility for the PPP can result from several factors, such as being involved in certain types of businesses, having legal issues, or failing to meet employee count requirements. Additionally, if your organization has already received significant funding through the CARES Act, you may not qualify. Be sure to read through the guidelines in the SBA Form 2483 to better understand your eligibility status. If needed, seek advice through platforms like US Legal Forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.