Get Sba Form 1353.2 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the SBA Form 1353.2 online

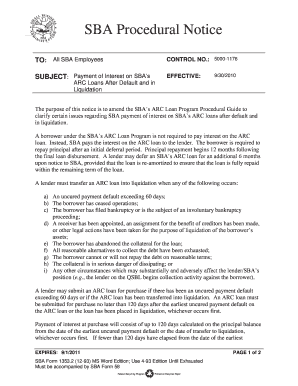

Filling out the SBA Form 1353.2 is a straightforward process, designed to facilitate necessary documentation for the SBA’s ARC Loan Program. This guide will provide you with step-by-step instructions on how to complete this form online efficiently and accurately.

Follow the steps to efficiently complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Review the form's introduction carefully to understand its purpose and components. This will guide you in filling it out correctly.

- Fill in your personal information in the designated fields, including your name, contact information, and loan details.

- Provide the lender's information, ensuring all required fields such as the lender’s name and contact information are accurately completed.

- Indicate any relevant loan details as requested, such as the amount borrowed and the loan’s purpose.

- Review all information entered for accuracy to avoid any errors that may delay processing.

- After confirming the accuracy of your entries, save your changes. You may also download or print the form if needed.

- If necessary, share the completed form with your lender or relevant parties as per your requirements.

Complete your SBA Form 1353.2 online today to ensure timely processing of your documentation.

Get form

Related links form

The primary purpose of the SBA is to support small businesses by providing them with access to capital, education, and resources necessary for growth. The agency also aims to encourage entrepreneurship, foster job creation, and stimulate economic development. By completing the SBA Form 1353.2, business owners can navigate the lending landscape more effectively, making their aspirations a reality.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.