Get Sba 2449 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA 2449 online

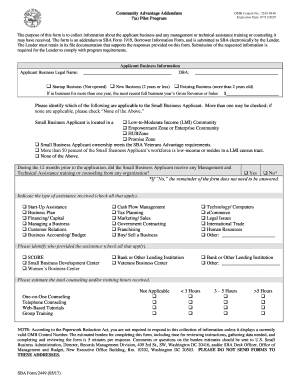

Filling out the SBA 2449 form is a crucial step for businesses seeking to provide information about their operations and assistance received. This guide will walk you through each section of the form in a clear and supportive manner, ensuring that you can complete it accurately online.

Follow the steps to successfully complete the SBA 2449 form.

- Click 'Get Form' button to obtain the SBA 2449 form and open it in your preferred online editor.

- Begin filling out the applicant business legal name in the designated field, ensuring it matches official records.

- Provide any 'Doing Business As' (DBA) name if applicable, or leave it blank if there is none.

- Select the appropriate option that describes your business status: Startup Business, New Business, or Existing Business.

- If your business has been operational for over a year, enter the most recent full business year's gross revenue or sales.

- Indicate any applicable classifications for your small business by checking the relevant boxes that may apply, or select 'None of the Above' if none fit.

- Answer whether the small business applicant received any management and technical assistance during the past 12 months by checking 'Yes' or 'No.' If you select 'No,' you may skip the remainder of the form.

- If you answered 'Yes' in the previous step, check all types of assistance received from the provided options.

- Identify who provided the assistance by checking all applicable organizations listed.

- Estimate the total counseling and/or training hours received, selecting the correct options for one-on-one counseling, telephone counseling, web-based tutorials, or group training.

- Review all your entries for accuracy before proceeding to submit the form.

- Once completed, you have the option to save your changes, download, print, or share the completed form.

Take the next step by filling out your SBA 2449 form online today!

Get form

An SBA audit may be triggered by various factors, such as inconsistencies in your application or the use of SBA funds. Additionally, the SBA 2449 initiatives have specific compliance requirements that, if unmet, can trigger a review. Regular financial misreporting can also draw attention from auditors. It’s important for borrowers to maintain accurate records and adhere to guidelines to avoid such audits.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.