Get Sba 1010 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA 1010 online

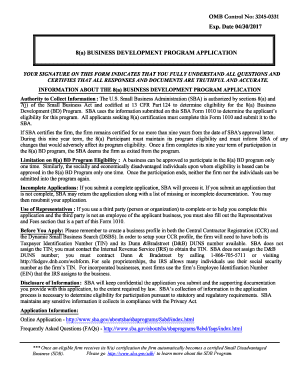

The SBA 1010 form is essential for qualifying as a certified Small Disadvantaged Business. This guide provides clear instructions on how to complete the form online, ensuring that you can navigate through each section with confidence.

Follow the steps to successfully complete the SBA 1010 form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Review the eligibility requirements for your firm to ensure that you qualify for 8(a) certification. This includes checking if your business is a corporation, limited liability company, partnership, or classified under AIT-owned categories.

- Begin filling out the general information section, including your business name, address, and contact information. Ensure that all details are accurate and up to date.

- Provide the necessary details regarding your business structure. Indicate whether you are a corporation, partnership, or limited liability company, and include any relevant notes related to AIT-owned applicant firms if applicable.

- Complete the sections on ownership and control. Detail the percentage of ownership and provide information about the owners' backgrounds to demonstrate the disadvantaged status of your business.

- Fill in financial information, including gross revenues and number of employees, as this data is critical for assessment purposes.

- Review all sections to ensure accuracy. It is important that all information reflects your organization truthfully and completely.

- Once the form is complete, save your changes, and then you have options to download, print, or share the form as needed.

Complete your SBA 1010 form online today to start your journey towards certification.

As of now, the SBA EIDL program has undergone various changes, but it remains an important lifeline for many businesses. The SBA 1010 initiative includes information about current funding opportunities, including any potential extensions or new applications. Always check the official SBA website for the most up-to-date details and eligibility. For completing your application efficiently, consider using US Legal Forms to access the resources you need.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.