Loading

Get Rrb Dc-1 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RRB DC-1 online

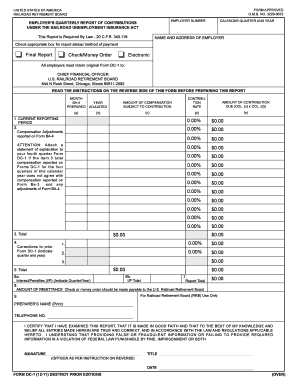

Completing the RRB DC-1 form online is essential for employers under the Railroad Unemployment Insurance Act to ensure accurate reporting of contributions. This guide offers a structured approach to help users complete the form efficiently, addressing each section with clarity.

Follow the steps to accurately complete the RRB DC-1 form online.

- Press the ‘Get Form’ button to access the RRB DC-1 form and open it in the editing environment.

- Fill in the employer number, select the calendar quarter and year for which you are reporting, and enter the full name and address of the employer in the respective fields.

- Check the appropriate box indicating the status of the report; if this is the final report, ensure that the 'Final Report' option is selected.

- Indicate the method of payment for contributions by selecting either 'Check/Money Order' or 'Electronic.'

- For Item 1, enter the total compensations subject to contribution for the current reporting period in column (c), the contribution rate in column (d), and calculate the amount of contribution due in column (e).

- For Item 2, document any compensation adjustments indicated on Form BA-4, including the month and year in columns (a) and (b), respectively, along with the adjusted amounts in columns (c) through (e).

- Calculate the total compensation and contributions, entering the totals in Item 3. Make sure these totals align with prior filed Forms BA-3 and BA-4.

- If there are corrections from prior Forms DC-1, record them in Item 4, including the original and corrected details across the specified columns.

- In Item 6, if applicable, indicate any interest or penalties by noting the relevant quarter and year in column (a) and the total amount in column (b).

- Complete Item 8 by entering the overall amount of remittance due, reflective of the total from Item 7.

- Sign the form, indicating the title and date, ensuring it is signed by an authorized representative as specified in the instructions.

- Finally, save your changes, and ensure that you download or print the completed document for your records and submission.

Begin filling out the RRB DC-1 form online today to ensure compliance with reporting requirements.

Related links form

RRB payment refers to the financial benefits provided to retired railroad employees and their families by the Railroad Retirement Board. This compensation aims to offer financial stability after retirement. To explore more about RRB payments, RRB DC-1 has comprehensive information that can guide you through the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.