Loading

Get Rrb Ba-9 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RRB BA-9 online

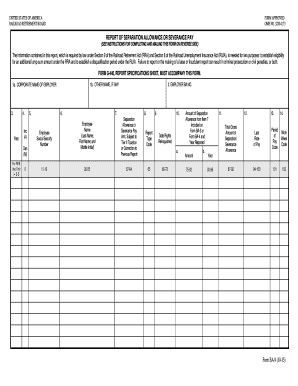

The RRB BA-9 form is crucial for reporting separation allowances or severance pay falling under the Railroad Retirement Act and the Railroad Unemployment Insurance Act. This guide provides a clear and supportive walkthrough for users to complete the form accurately online.

Follow the steps to effectively fill out the RRB BA-9 form.

- Click the ‘Get Form’ button to obtain the RRB BA-9 form and open it in the editor.

- Begin by entering the corporate name of the employer in the designated field.

- If applicable, input any other name commonly used for business purposes in the next field.

- Enter the four-digit Railroad Retirement Board employer number, not the IRS employer identification number.

- Specify the applicable four-digit tax year.

- Indicate whether this is an initial report or an increase adjustment by entering '4' for an initial report or 'M' for a decrease adjustment.

- Input the employee's social security number in the provided space.

- Enter the employee's last name (up to 20 letters), first name (up to 15 letters), and middle initial.

- For the separation allowance or severance pay subject to Tier II taxation, include the appropriate amount; if reporting an adjustment, note the change value.

- Indicate the type of report by entering '1' for an initial report, '2' for an adjustment report, '3' for a periodic payment, or '4' for a final periodic payment.

- Provide the separation date in MMDDYYYY format indicating when the employee relinquished employment rights.

- Detail the amount of the separation allowance included in prior reports, if applicable, and the year it was reported.

- Sum the total gross amount of separation or severance allowance and ensure it reflects whole dollars without cents.

- Include the last rate of pay and select the appropriate code corresponding to the pay period (hour, day, week, month).

- Enter the code for the normal workweek to reflect the employee's working hours.

- Once all fields are accurately completed, save your changes, and choose to download, print, or share the form as necessary.

Complete your RRB BA-9 form online today for accurate reporting.

The taxable portion of a 1099-R often depends on the source of the funds and previous contributions. Generally, if you contributed to the pension plan with after-tax dollars, you may have a non-taxable portion. It's wise to refer to the RRB BA-9 when determining the taxable portion of your 1099-R.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.