Loading

Get Ctcac Tenant Household Information Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CTCAC Tenant Household Information Form online

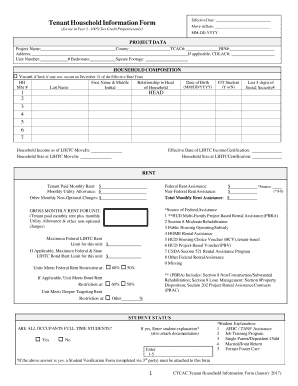

The CTCAC Tenant Household Information Form is a crucial document for individuals seeking to provide necessary household details for tax credit purposes. This guide will assist you in navigating each section of the form online, ensuring that you complete it accurately and efficiently.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the CTCAC Tenant Household Information Form and open it for online completion.

- Enter the effective date for the certification, which should align with the last certification or recertification date.

- Fill in the Move-In Date, which represents the most recent date the household qualified for tax credit purposes.

- Provide project data including the project name, address, county, unit number, number of bedrooms, TCAC#, and BIN# if applicable.

- List all household members in the Household Composition section, including their first name, last name, relationship to the head of household, date of birth, student status, and last four digits of their social security numbers.

- Document the household income and size as of LIHTC move-in, as well as the effective date of LIHTC income certification.

- Complete the Rent section by entering the tenant-paid monthly rent, monthly utility allowance, and any other non-optional charges.

- Indicate the federal and non-federal rent assistance received and calculate the total monthly rent assistance.

- Check applicable boxes for maximum rent limits and income restrictions, ensuring compliance with federal requirements.

- Verify if all occupants are full-time students and provide necessary explanations or documentation if applicable.

- Secure signatures from all tenant members age 18 or older and the owner or representative, ensuring the document reflects accurate representations.

- Once completed, save your changes, and proceed to download, print, or share the form as required.

Complete the CTCAC Tenant Household Information Form online today to ensure timely submission and compliance with tax credit requirements.

A tenant income certification form verifies the income of potential tenants, ensuring they meet specific rental requirements. This form is crucial for landlords aiming to qualify tenants for affordable housing programs. Utilizing the CTCAC Tenant Household Information Form can simplify the income verification process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.