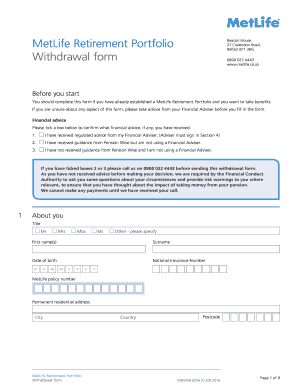

Get Metlife Rp Withdrawal 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MetLife RP Withdrawal online

How to fill out and sign MetLife RP Withdrawal online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Locating an accredited specialist, arranging a planned appointment, and visiting the office for an in-person meeting makes completing a MetLife RP Withdrawal from beginning to end exhausting.

US Legal Forms allows you to swiftly create legally enforceable documents using pre-designed online templates.

Quickly generate a MetLife RP Withdrawal without the need to consult professionals. More than 3 million users are already benefiting from our exclusive range of legal forms. Join us now and access the top library of online templates. Experience it for yourself!

- Identify the MetLife RP Withdrawal you require.

- Access it through the online editor and commence modifications.

- Complete the blank fields; names, addresses, and contact numbers of involved parties, etc.

- Alter the template with custom fillable sections.

- Insert the specific date and affix your electronic signature.

- Hit Done after reviewing all the information.

- Retrieve the prepared documents to your device or print them out as a hard copy.

How to Modify Get MetLife RP Withdrawal 2016: Personalize Documents Online

Experience a hassle-free and paperless method for adjusting Get MetLife RP Withdrawal 2016. Utilize our dependable online service and save considerable time.

Creating every document, including Get MetLife RP Withdrawal 2016, from the beginning consumes too much time, so having a proven platform of pre-made templates can significantly enhance your efficiency.

However, adjusting them can be difficult, particularly for documents in PDF format. Thankfully, our vast collection includes a built-in editor that allows you to effortlessly fill out and modify Get MetLife RP Withdrawal 2016 without leaving our site, ensuring you don’t squander your valuable time on paperwork. Here’s what you can accomplish with your document using our service:

Whether you need to process editable Get MetLife RP Withdrawal 2016 or any other document found in our inventory, you’re on the right path with our online document editor. It's straightforward and secure and doesn’t necessitate a specialized technical background.

Our web-based service is engineered to manage almost anything you can think of regarding document editing and completion. Stop using outdated methods for handling your documents. Opt for a professional solution to assist you in streamlining your tasks and reducing reliance on paper.

- Step 1. Locate the required document on our site.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize our specialized editing tools that enable you to add, eliminate, annotate, and highlight or obscure text.

- Step 4. Create and append a legally-valid signature to your document using the sign option in the upper toolbar.

- Step 5. If the document layout doesn’t appear as you wish, use the tools on the right to delete, add, and rearrange pages.

- Step 6. Incorporate fillable fields so that others can be invited to complete the form (if necessary).

- Step 7. Distribute or send the document, print it out, or choose the format in which you prefer to download the file.

The withdrawal amount from your MetLife TCA debit card primarily depends on your total control account balance. Typically, you can withdraw up to a certain limit within a single transaction. It's crucial to check the specific limits set by MetLife to avoid any inconvenience. If you need more information, platforms like USLegalForms can provide valuable insights into managing your funds.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.